Welcome to

your quarterly

report

As the energy crisis unfolds, businesses are left with difficult choices

Paying more for energy usage is a bitter pill that no business – or household - would ever wish to swallow. But as the energy crisis unfolds, businesses are left with only difficult choices. High energy prices are likely to stay with us for the foreseeable future.

This is compounded by mounting supply chain pressures and spiralling cost of raw materials which are stoking inflationary expectations in the economy.

According to the latest British Chambers of Commerce Q3’21 economic survey(1), 62% of manufacturers expect their prices to rise in the next three months, whilst 51% of companies in the service sector cited inflation as an increased cause of concern.

Furthermore, firms operating in energy intensive industries such as steel, chemicals, glass and fertilisers have warned that soaring gas and electricity costs could force them to reduce operations or temporarily close.

UK Steel, the trade association representing steelmakers, has said it was now “uneconomic” to make steel at certain times, with companies facing double the electricity prices paid by rivals in Germany, France and the Netherlands (2).

In late September, British Steel, the UK’s second-largest steelmaker, announced a temporary surcharge of £30 per tonne citing that energy costs have reached levels they can no longer absorb alone. As a result, prices for domestically manufactured products used in the construction and car manufacturing industries are likely to go up.

There are all sorts of knock-on effects. For instance, the trade association of glass makers, British Glass, has said some of its members that make windows are seriously considering to revert to powering their furnaces with polluting fuels that had been abandoned (2).

And in mid-September, CF Industries, a global producer of fertilisers, shut down two plants in northern England because of high gas prices.

Medium-sized businesses too are feeling the heat with almost a third (29%) of businesses surveyed planning to increase prices for their products or services in the next three to six months(3). Staff shortages and supply chain disruption were mentioned as the two main drivers putting severe pressure on mid-sized businesses when they responded to a survey conducted by BDO back in July.

It’s very likely that soaring energy costs are now top of the list of worries facing medium-sized enterprises.

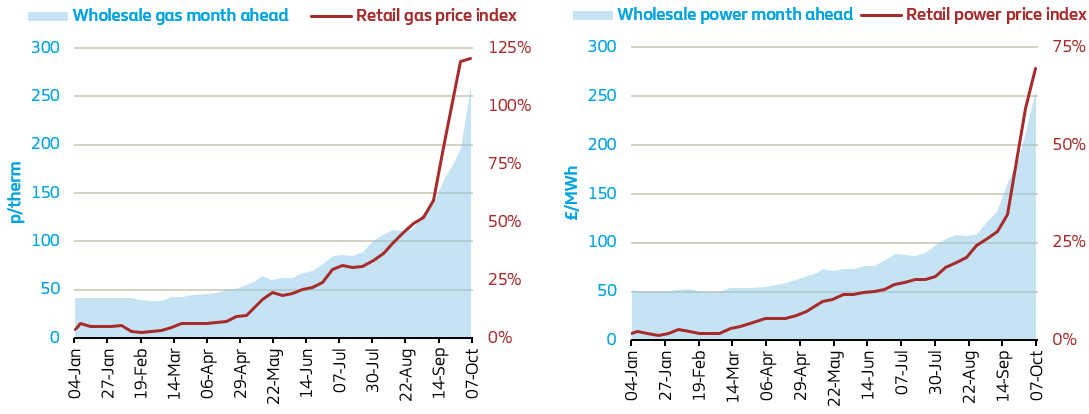

Indeed, business energy retail prices have climbed to record levels. This year, the average annual price for a 2-year contract for a medium-sized business consuming 203MWh of gas has increased by 120%, whilst for electricity it has risen by 75% based on 185MWh usage(4).

Energy suppliers buy forward in the wholesale gas and power markets to supply their customers and hedge their costs. These can be done in traded periods ranging from within-day (spot market), day-ahead and week ahead (prompt market) or month, season, year ahead (forward market). Near term markets have more liquidity and can be more volatile than longer term markets.

Suppliers – and other participants such as generators, banks/hedge funds, commodity traders/speculators – trade across all these periods. That said, probably one of the most popular and therefore closely watched traded period is month ahead or front month.

Latest energy industry news

Sources & Notes:

(1)British Chambers of Commerce Quarterly Economic Survey Q3: Economy Under Strain https://www.britishchambers.org.uk/news/2021/10/quarterly-economic-survey-q3-economy-under-strain

(2)The Guardian: UK industry could face shutdowns as wholesale gas price hits record high, 6th October 2021

(3)Bimonthly survey of 500 medium-sized businesses. Medium sized businesses are defined as businesses with revenue between £10-£300m. The survey was conducted by Censuswide on behalf of BDO in July 2021 https://www.bdo.co.uk/en-gb/news/2021/uk-s-mid-sized-businesses-warn-of-reduced-stock-and-higher-prices-because-of-staff-shortages

(4)Based on average annualised prices for a mid-sized business consuming 203MWh and 185MWh of gas and electricity (NHH) respectively from a sample of 18 suppliers’ broker price books

(5)Intercontinental Exchange (ICE) UK natural gas future and base electricity future month ahead prices

(6)LinkedIn: Tony Jordan from Auxilione and Latif Faiyaz from Norther Gas & Power

(7)Goldman Sachs 2021 Commodity Outlook: REVing up a structural bull market 18th November 2020 https://static.classeditori.it/content_upload/doc/2020/11/202011201713428082/GS-2021CommodityOutlook_REVingupastructuralbullmarket.pdf

British Gas and Centrica Business Solutions

As the largest business energy supplier in the UK, we care about creating a cleaner planet and helping you reduce your carbon emissions. That is why we’re now part of Centrica Business Solutions. By combining our knowledge and expertise, we’ll be able to provide you with advice and technologies that enable you to save, reuse and manage your energy sustainably.