Wholesale prices surging

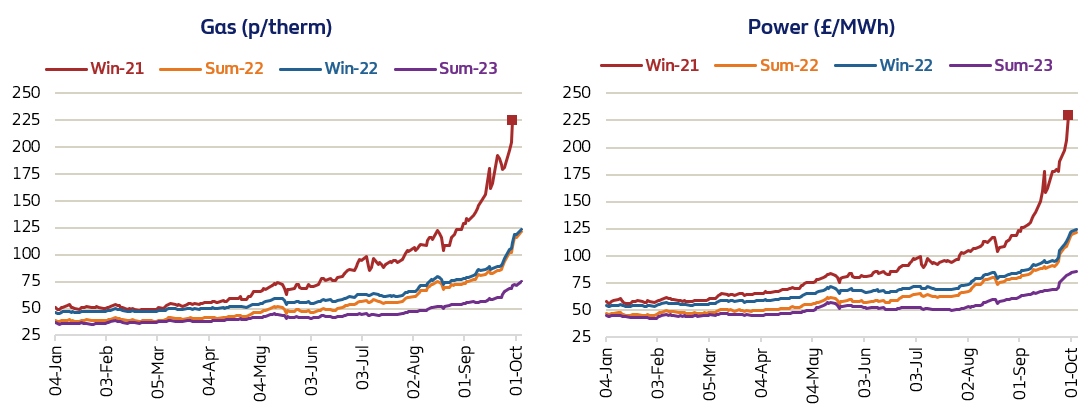

Wholesale gas and power month ahead prices have surged to new records this year. Prices have increased by a staggering 585% and 430% respectively, from 40p/therm and £50/MWh at the beginning of January to 274p/therm and £265/MWh by 6th October(5) .

That day, the UK wholesale gas market experienced its most volatile day of trading ever. Front month (Nov’21) opened at 331p/therm and initially surged by 40% and broke through the 400p/therm mark. However, following comments by President Putin that Russia might pump more gas to Europe, prices declined swiftly and the market closed at 274p/therm.

“That’s some swing!” said one industry commentator. Another said” who needs Bitcoin when you can have gas!” (6).

It appeared that wholesale gas-price-watching has become a national hobby!

Prices for the coming seasons also saw unprecedented increases. Quarter three saw Winter 21 gas and power contracts expire. These rose by an eye watering 442% and 396% in the nine months to the end of September respectively.

Although energy prices have spiralled skywards in recent weeks, this cycle of high energy prices has not been a sudden event but rather the result of months and even years of simmering imbalances.

Energy prices are following a broad rally in commodities from metals and agriculture (grains and oilseeds) to crude oil. Many believe that the global economy has entered a new commodities “supercycle”(5) and in this context surging energy prices are the latest manifestation of this wider trend.

Undoubtedly, the energy market is global and interdependent, however, the turmoil in the gas market has exposed structural weaknesses in the UK energy system – which we discuss in another section of this report.

While the lights may not be going off anytime soon, businesses are left with only difficult choices – some of which are discussed in a bit more detail in the next section.

Sources & Notes:

(1)British Chambers of Commerce Quarterly Economic Survey Q3: Economy Under Strain https://www.britishchambers.org.uk/news/2021/10/quarterly-economic-survey-q3-economy-under-strain

(2)The Guardian: UK industry could face shutdowns as wholesale gas price hits record high, 6th October 2021 https://www.theguardian.com/business/2021/oct/06/uk-industry-could-face-shutdowns-as-wholesale-gas-price-hits-record-high

(3)Bimonthly survey of 500 medium-sized businesses. Medium sized businesses are defined as businesses with revenue between £10-£300m. The survey was conducted by Censuswide on behalf of BDO in July 2021 https://www.bdo.co.uk/en-gb/news/2021/uk-s-mid-sized-businesses-warn-of-reduced-stock-and-higher-prices-because-of-staff-shortages

(4)Based on average annualised prices for a mid-sized business consuming 203MWh and 185MWh of gas and electricity (NHH) respectively from a sample of 18 suppliers’ broker price books

(5)Intercontinental Exchange (ICE) UK natural gas future and base electricity future month ahead prices

(6)LinkedIn: Tony Jordan from Auxilione and Latif Faiyaz from Norther Gas & Power

(7)Goldman Sachs 2021 Commodity Outlook: REVing up a structural bull market 18th November 2020 https://static.classeditori.it/content_upload/doc/2020/11/202011201713428082/GS-2021CommodityOutlook_REVingupastructuralbullmarket.pdf