Business energy procurement enters choppy water

Business energy retail prices had been increasing gradually throughout Q1 and Q2. However, in July the market saw some significant price increases during the first week. But some of these increases were reversed as suppliers reduced prices by mid-month.

In electricity, most suppliers made small increases at the start of the month and kept their rates broadly unchanged for the remainder of July.

Things changed dramatically in August when the majority of suppliers raised prices for both gas and electricity. Gas prices in particular were revised upwards by many suppliers on a weekly basis.

September saw even more instability and higher prices until around the middle of the month when one by one suppliers started to withdraw prices available to brokers and stopped taking on new customers.

Some suppliers returned to the market week commencing 20th September but were offering only 12-month contracts instead of longer term ones. Others simply decided to price themselves out of the market.

By the end of the month, very few were accepting new customers.

During September, nine energy suppliers, primarily supplying the domestic market, had failed and their customers passed onto new suppliers. More suppliers are expected to exit the market this year as explicitly stated by the industry regulator Ofgem (8)

For business customers of all sizes the impact of this crisis is immediate, particularly for those who are looking for a new contract. Businesses face only difficult choices:

•Sign a new short-term contract (12 months) and pay for your energy at current rates with the hope that prices will come back down next year

•Sign a longer-term contract to “average down” the cost of energy but risk paying more if the market falls during your contract

•Wait to see if there is a price correction in the next few weeks or months and move onto an out of contract (OOC) tariff

•Some suppliers are opening up fixed price contracts mid-term and advising their customers that market conditions have forced them to increase prices and that they can either accept the new tariff or leave the contract with no penalties

•Reduce or even shut down your operations if higher energy prices make your operations uneconomical

Although the last option seems extreme, as discussed in the previous section, we are already seeing some large and medium sized enterprises, which are either planning to reduce their operations or have already started doing so.

Moreover, at the time of writing, the British Chambers of Commerce called for an energy price cap to be introduced for small and medium-sized enterprises, just like the one protecting domestic consumers.

Businesses opting for an OOC tariff could face paying significant premiums depending on who their supplier is. In some cases, these rates could severely impact the viability of a business.

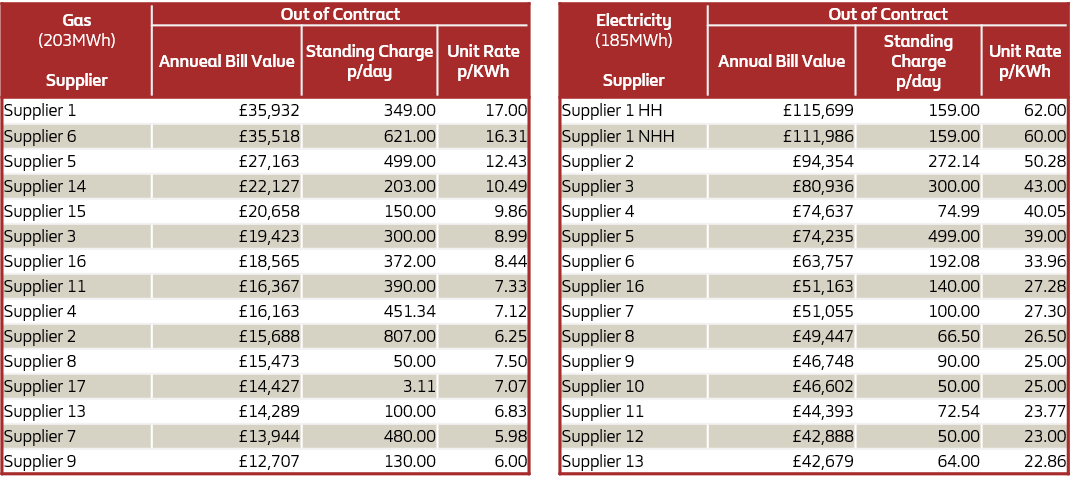

A sample of 17 business suppliers’ OOC rates reveals a very wide range of charges and the impact on estimated annual bill values for medium-sized companies(9). These rates are constantly being reviewed as suppliers catch up with the market.

Worth pointing out that a significant proportion of businesses will still be in contract through winter at lower prices so largely immune from the current price spikes.

Sources & Notes:

(8)Reuters: UK energy regulator says more suppliers may go bust over high prices, 7th October 2021 https://www.reuters.com/business/energy/uk-energy-regulator-says-more-suppliers-may-go-bust-over-high-prices-2021-10-07/

(9) OOC rates for 17 business energy suppliers as collated from their websites on 6th October 2021