The latest view and outlook for energy costs

2020 and 2021 have been remarkable years for the energy market. In the space of 18 months, the market has gone from one extreme to the other with the phrase “demand destruction” going full circle.

Initially it was used to describe the collapse in energy consumption by businesses as a result of the lockdowns, and now is also used to describe a decline in demand but for completely different reasons; namely businesses reducing or even halting operations as a result of exponential energy prices.

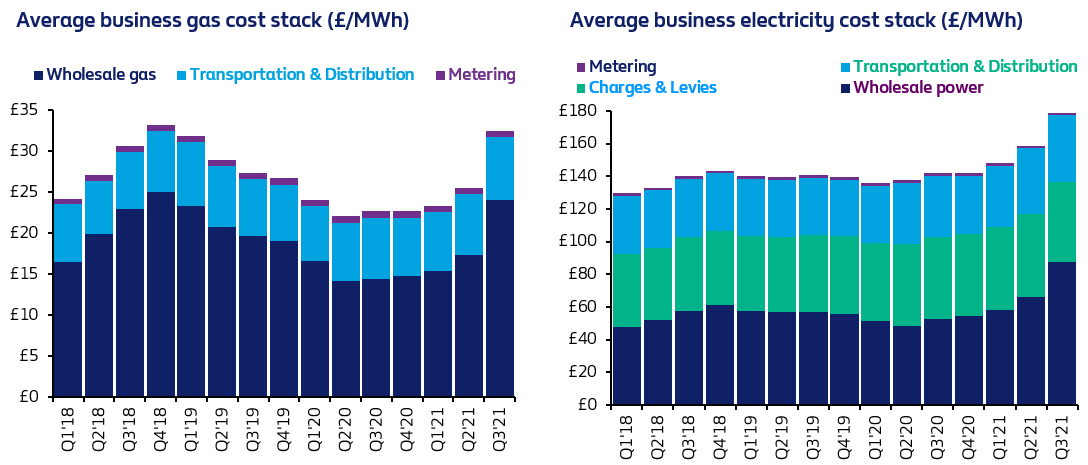

By the end of Q3, a medium-sized business looking for a new gas or electricity contract would have paid 43% and 26% more respectively than a year ago (4).

The commodity element of an indicative business gas cost stack increased from 64% in Q3’20 to 74% in Q3’21, whilst for electricity it went up from 37% to 49% over the same period (10).

The cost of buying the energy in wholesale markets has been the main driver pushing overall costs higher.

A number of factors have contributed to an aggravated energy crisis in the UK and Europe that is hitting customers now and is expected to do so over the next few months.

Energy demand has been driven by a combination of factors including a strong recovery from the Covid-19 lockdowns globally, Russian supply bottlenecks, delays to nuclear power maintenance and the weather as in colder winters and lack of wind amongst other drivers.

One of the main factors continued to be gas storage in the UK and Europe which are currently just under 76% full, compared with a 10-year pre-winter average of almost 90% (11)

If this winter sees an average drawdown, storage sites would be reduced to just 19% full by the spring, which in turn would leave the UK and Europe with a persistent gas shortage next year.

The other two scenarios, a moderately strong draw and a maximum draw, would reduce storage to 8% and to almost nil respectively by the spring. As a result, there is a scramble for gas to avert such scenarios.

To add fuel to the fire, there has been a strong recovery from the Covid-19 pandemic and heightened competition for gas from Asia particularly China. These economies are looking to secure additional volumes of long-term gas and bidding up LNG spot cargoes. In fact, Chinese authorities are reportedly ordering state energy companies to secure supply for the winter “at all costs.” (12)

Back to the UK, another contributing factor is related to the latest wave of supplier failures and the Supplier of Last Resort (SoLR) process. 12 energy firms have gone bust with customers transferred to other providers. The new suppliers are taking on customers who are fully unhedged and as a result they have to go to market to secure uninterrupted energy supply for these customers.

Finally, the weather, always the weather. The UK is heavily reliant on natural gas and wind for its energy: about 36% came from gas and 21% from wind in 2020. However, between April and September this year, the UK experienced a period of historically low winds with some of the largest wind power generators reporting a 30% decline in output during this period.

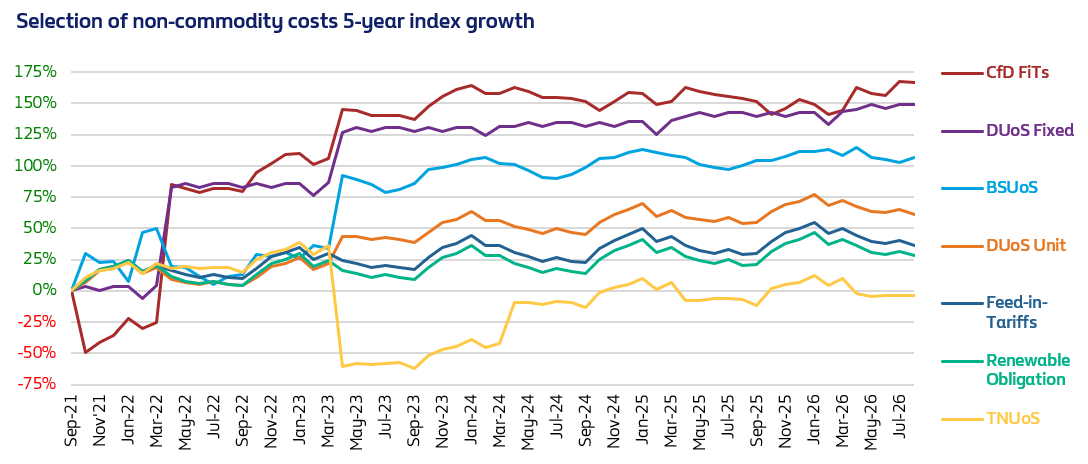

In addition, a number of non-commodity costs or third party charges have also increased, albeit at a slower pace.

In gas, transportation & distribution costs rose by 4% in Q2’21 compared to Q1’21 and a by a further 3% in Q3’21.

Likewise, in electricity transportation and distribution costs increased by 2% in Q3’21 on top of a 7% and 5% rise during Q2’21 and Q1’21 respectively.

On the other hand, soring power prices particularly for 2021/22 and 2022/23 acting to reduce CfD rates forecast significantly.

The outlook for non-commodity charges remains broadly unchanged from our last quarterly market report (13). Increases for Renewable levies, DUoS and BSUoS are expected from the spring and further out driven by; new renewable generators coming online, latest commodity prices and system balancing costs remaining high.

Sources & Notes:

(10)Indicative commodity and non-commodity forecasted costs based on portfolio averages for gas and non-half hourly meters. Non-commodity costs include: Transmission & Distribution components (TNUoS, BSUoS, DUoS) and Charges & Levies (RO, CCL, CfDs, CM)

(11)Moody’s: Gas Explosion: What Caused the 2021 UK Energy Crisis? https://www.moodysanalytics.com/articles/2021/gas%20explosion-what%20caused%20the%202021%20uk%20energy%20crisis

(12)The Energyst: “Keep North Sea taps open”, urges UK gas group, as China buys energy ‘at all costs” https://theenergyst.com/keep-north-sea-taps-open-urges-uk-gas-group-as-china-buys-energy-at-all-costs/

(13) Selection of non-commodity forecasted costs for a sample business customer with a non-half hourly meter