Gas crunch exposes structural weaknesses in the UK energy system

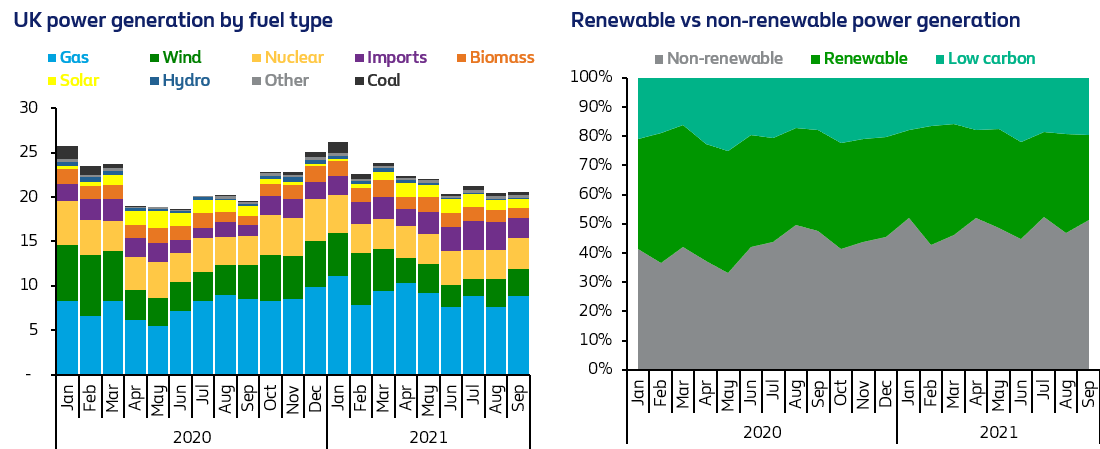

The UK energy mix has seen a significant change in 2021 compared to last year.

The share of renewable power (wind, biomass, solar and hydro) has declined from 38% in 2020 to 33% in the first nine months of 2021. In contrast, non-renewables (gas and coal) accounted for 49% of the UK’s energy mix over the same period(14).

With the UK experiencing a period of historically low winds between April and September this year, the country has become highly reliant on gas at the worst possible time given the conditions in global energy markets.

Although recent events have highlighted the vulnerability of the UK to gas prices, the very structure of the current energy system appears to be the source of the problem and has become the subject of much debate.

With North Sea gas production falling sharply since the mid-2000s, whilst at the same time demand continuing to rise, the UK has become increasingly dependent on gas imports.

Around half of its gas comes from Norway, Belgium and the Netherlands via pipelines and the rest by ship in the form of LNG from Qatar, Russia and the US.

Furthermore, the UK has very limited storage capacity with less than 1% of Europe’s stored gas located in the country.

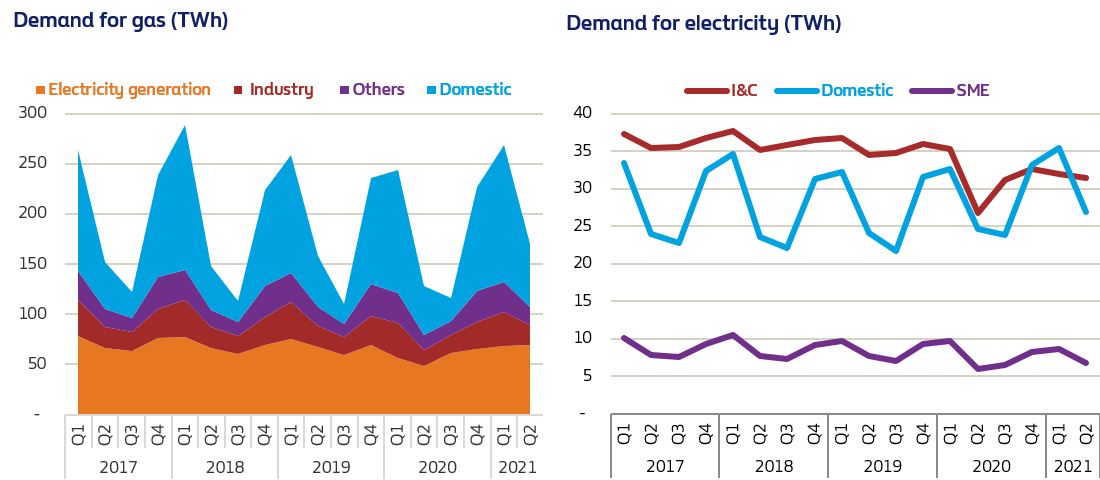

Looking at a 5-year trend of demand for gas, except for a dip in Q2’20 as a result of the first lockdown, not much has changed. The longer term trend of imports gradually increasing, whilst exports’ slow decline continues(15).

Gas is deeply ingrained in the UK economy with around 86% of households using gas for heating. Likewise, demand for gas for industrial purposes is also pervasive.

In terms of electricity demand (16), figures for Q2’21 show an increase of 14% year-on-year with demand from Industrial & Commercial (I&C) users jumping by 17% over this period, followed by SMEs with 13% and residential with 10% (11).

During Q2, I&C users demanded more energy than domestic users, reversing the previous quarter’s decline when for the first time residential demand outstripped consumption by large industrial customers. This was driven by the third lockdown and people working from home during the winter months.

Comparing electricity demand in Q2’21 to a more normal quarter like Q2’19, shows that only households saw an increase in consumption of 12%, whilst SME and I&C demand declined by 12% and 9% respectively.

Sources & Notes:

(11) Moody’s: Gas Explosion: What Caused the 2021 UK Energy Crisis? https://www.moodysanalytics.com/articles/2021/gas%20explosion-what%20caused%20the%202021%20uk%20energy%20crisis

(14) UK power generation by fuel type: BMRS Reports Elexon and solar generation from Sheffield Solar

(15) Department for Business, Energy & Industrial Strategy (BEIS) Energy Trends Statistical Release April to June 2021

(16) Elexon Balance & Settlement Code (BSC) supplier volume allocation Q2’21