Wholesale energy prices are returning to pre-Russia/Ukraine conflict levels, but volatility remains high

Wholesale energy markets are returning to pre-Russia/Ukraine conflict levels. Gas and electricity prices have reached two-year lows as 2024 gets underway. Current market dynamics reflect the impact of measures to secure energy supply in the UK and in Europe.

The below charts tell you the story of wholesale energy prices during 2023 (8). The year can be broadly divided into three main periods:

- Prices continued their steep downward trend during Q1 from the unprecedented highs experienced in the summer of 2022

- Markets entered a range-bound volatile period from April/May until the end of November

- Power and gas prices (Summer 24) broke through the £100/MWh and 100p/therm thresholds in late November and early December respectively, By mid-January, power and gas prices have declined by 28% and 31% respectively from the start of December.

Year-on-Year (YoY), wholesale gas and power prices are down by 54% and 56% respectively but remained well above their long-run average.

Recent developments affecting markets

Energy prices are trading lower despite ongoing geopolitical turmoil in the Middle East and disruption of shipping traffic transiting the Red Sea.

Israel’s war against Hamas has entered its fourth month and the conflict appears to have expanded beyond its borders with Yemen-based Houthi rebels declaring war on Israel.

Houthi forces launched ballistic and cruise missiles on southern Israel in November and have escalated attacks on commercial ships and tankers passing through the Red Sea.

As a result, several shipping companies have rerouted their vessels away from the Suez Canal, whilst others have suspended navigation through the Red Sea all together.

These include tankers transporting Liquified Natural Gas (LNG) destined for Europe and the UK. For instance, QatarEnergy, the world’s second largest LNG shipper, stopped sending tankers via the Red Sea on 15 January (9).

However, the Red Sea disruption has had little or no impact on wholesale energy prices. One of the main reasons is because the volume of LNG affected is relatively small.

In addition, any shortfall in shipments of LNG to Europe could be made up by supplies from the United States. In 2023, the United States became the largest LNG exporter, overtaking both Qatar and Australia.

LNG contracts are generally more flexible now than in the past, therefore can provide important short-term flexibility to international gas markets (10).

The UK has three permanent LNG terminals (Isle of Grain, South Hook and Dragon) and in January as many as 26 tankers were scheduled to arrive, adding further downward pressure to wholesale gas prices (11).

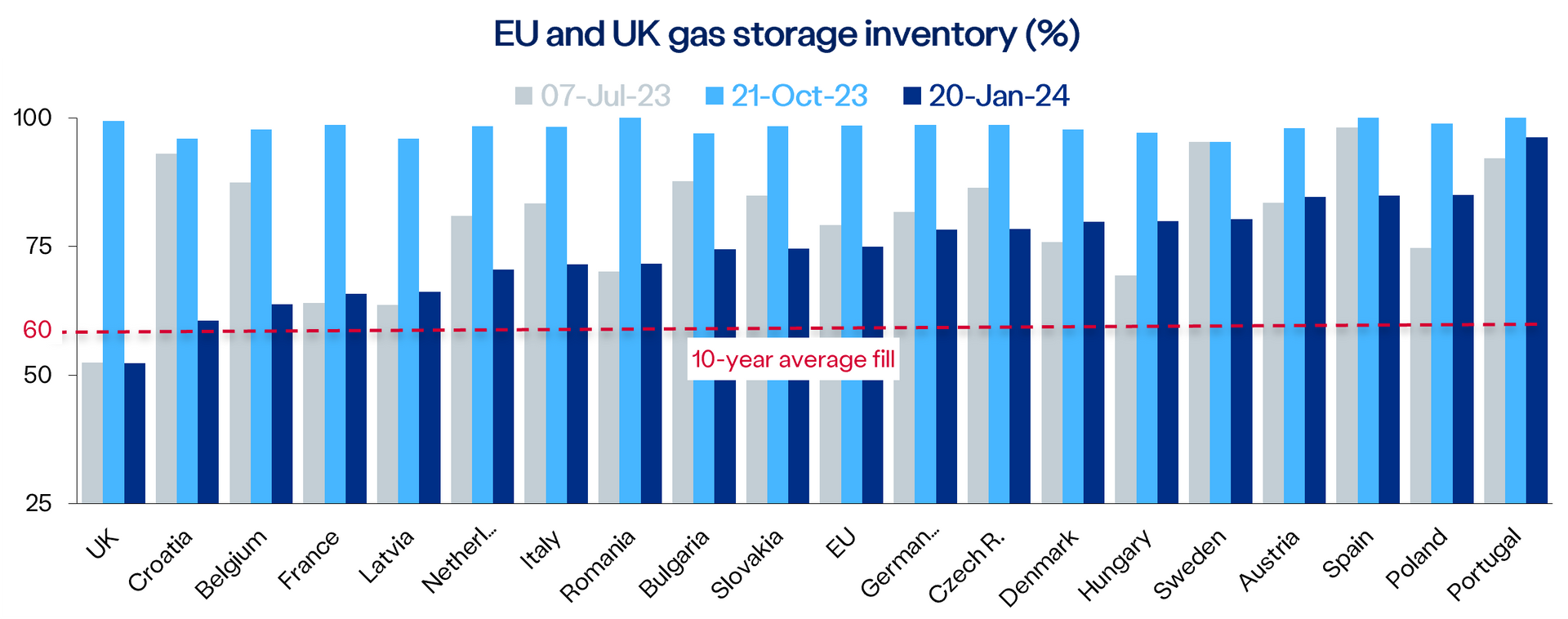

Gas storage levels remain above average across Europe despite recent large withdrawals due to the cold weather (12).

Based on weather patterns and depletion rates over the last ten years, Europe and UK gas storage sites are on course to end the winter of 2023/24 at or near a record high (13).

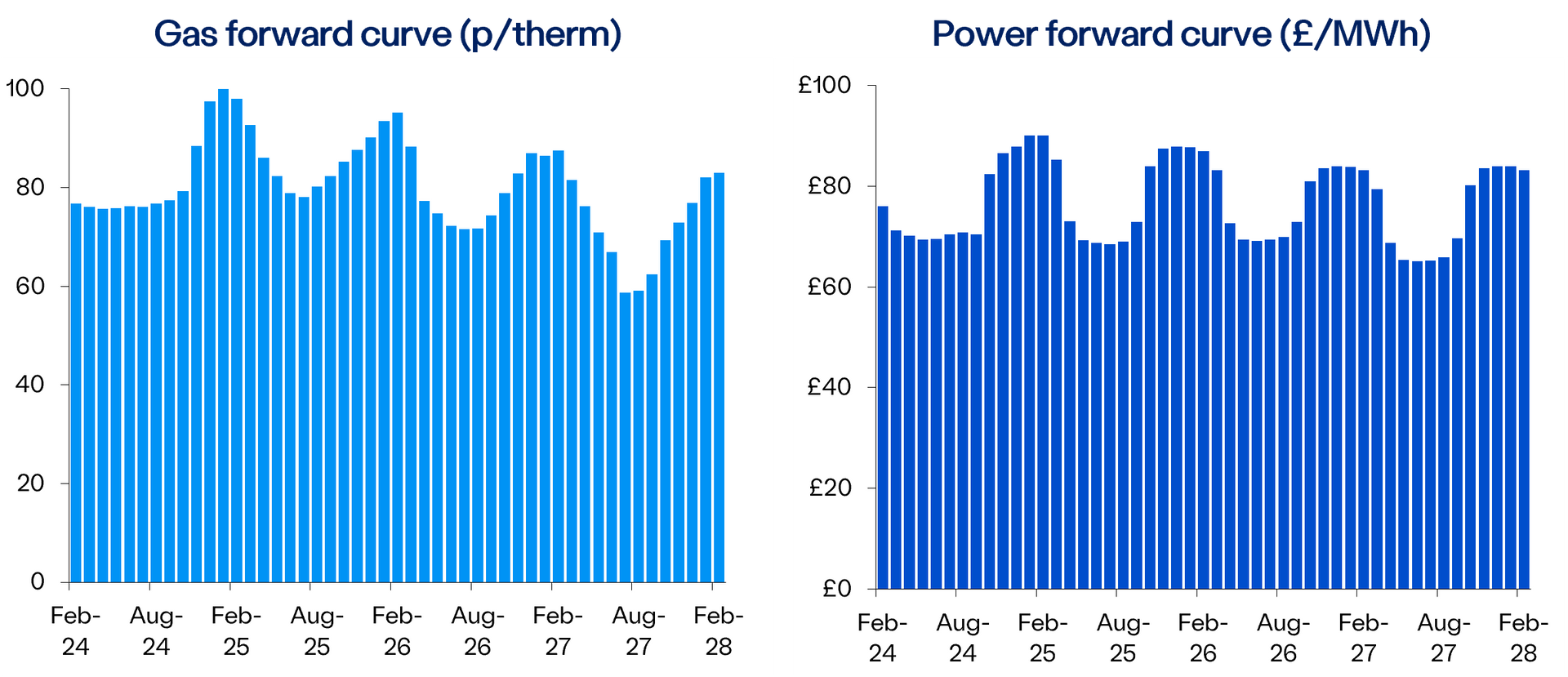

Forward curves indicate a levelling of prices over the next few years

With supply risks remaining low for the foreseeable future, ample gas storage capacity, more renewable energy on stream with low marginal costs and economic headwinds likely to continue easing, forward curves show a levelling of prices over the next few years (14).

However, extreme weather events like the Beast from the East of 2018, could have a significant impact on energy markets. Storms like these are hard to predict well in advance.

Furthermore, increased competition for LNG from thriving Asia economies could also result in a global race for securing gas supplies.

Whilst wholesale energy prices are moving into a new more stable area, the market remains fragile and highly susceptible to fluctuations in demand.

Sources & Notes:

8)Intercontinental Exchange (ICE) UK NBP natural gas and base electricity future prices for Summer 24, Winter 24, Summer 25 and Winter 25

9)QatarEnergy halts Red Sea LNG shipping amid attacks, seeking security advice, Reuters 15 January 2024 https://www.reuters.com/world/middle-east/lng-tankers-held-up-over-weekend-following-us-uk-strikes-houthis-data-2024-01-15/

10)The geopolitics of energy in Europe: Short-term and long-term issues, Simone Tagliapietra June 2022 https://www.funcas.es/articulos/the-geopolitics-of-energy-in-europe-short-term-and-long-term-issues/

11)Texas LNG for UK, LNG Journal 19 January 2024 https://lngjournal.com/

12)GIE Aggregated Gas Storage Inventory, 21 October 2023 https://agsi.gie.eu/

13)Europe’s gas price falls to encourage more industrial use, Reuters 5 January 2024 https://www.reuters.com/business/energy/europes-gas-price-falls-encourage-more-industrial-use-kemp-2024-01-04/

14)Natural Gas and Power curves are published based upon our use of Intercontinental Exchange (ICE) settlement data

https://www.ice.com/products/910/UK-NBP-Natural-Gas-Futures