Third party costs update and outlook

A customer’s energy bill is made up of much more than just the cost of the raw energy and supplier costs – indeed these typically make up only half of a typical energy bill.

The remainder of the bill is made up of a wide range of cost components that directly pay towards the maintenance, security and development of the energy infrastructure that is essential to delivering energy to customers’ homes and businesses.

These costs are known as third party costs (TPC) or non-commodity, or non-energy charges.

These charges can broadly be split into two categories:

Network Charges

- These charges are levied by the network operators for the maintenance, development and balancing of the electricity networks.

- The charges can be split out by Distribution, Transmission and Balancing (electricity only) charges and are recovered via consumption-based, fixed and capacity charges.

Policy Costs

- These are charges introduced by the government to help support and subsidise the transition towards low carbon generation and the challenges this creates.

- These include charges that encourage the development of low carbon generation (Renewable Obligation, Contract-for-Difference FiTs (both large scale generation) and Feed-in-Tariffs (small scale), as well as the Capacity Market scheme, that was set up to ensure adequate flexible generation capacity is available at times of peak demand or low supply.

Each charge varies greatly in terms of what drives the level of cost, when the charges are published and how they are recovered.

The networks are closely regulated by Ofgem and as such there is much more transparency around how they are calculated and more notice and certainty around publication of final rates.

Whereas with policy costs depending on the mechanisms involved the final rate may not been fully known till after the charging year is over.

Subsequently for fixed price contracts, depending on the start date and duration of a contract, a large proportion of your non-commodity charges can be based on rates forecasted by the supplier.

Electricity Third Party costs going forward

Even with greater near-term certainty around network charges, there will always be uncertainty about third party costs further out. The main factors that determine future third party costs are the wholesale energy prices, inflation and political uncertainty.

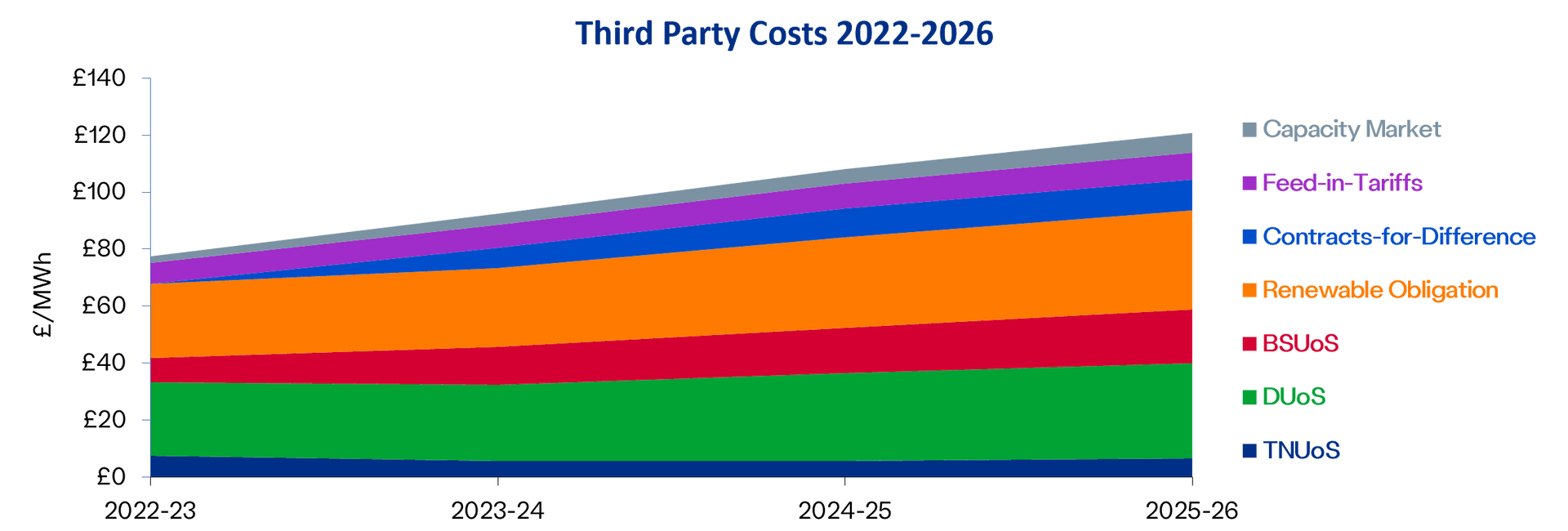

As the graph shows below, even with energy prices and inflation starting to return to normal, 'third party' costs are still expected to increase steadily in the years ahead.

Let’s take a look at some of the most prominent electricity TPCs.

Distribution Use of System (DUoS)

DUoS charges represent a significant component of non-commodity costs for businesses. DUoS refers to the charges levied on electricity consumers for the use of the distribution network, in this case, the infrastructure responsible for the delivery of electricity from the national grid to homes and businesses.

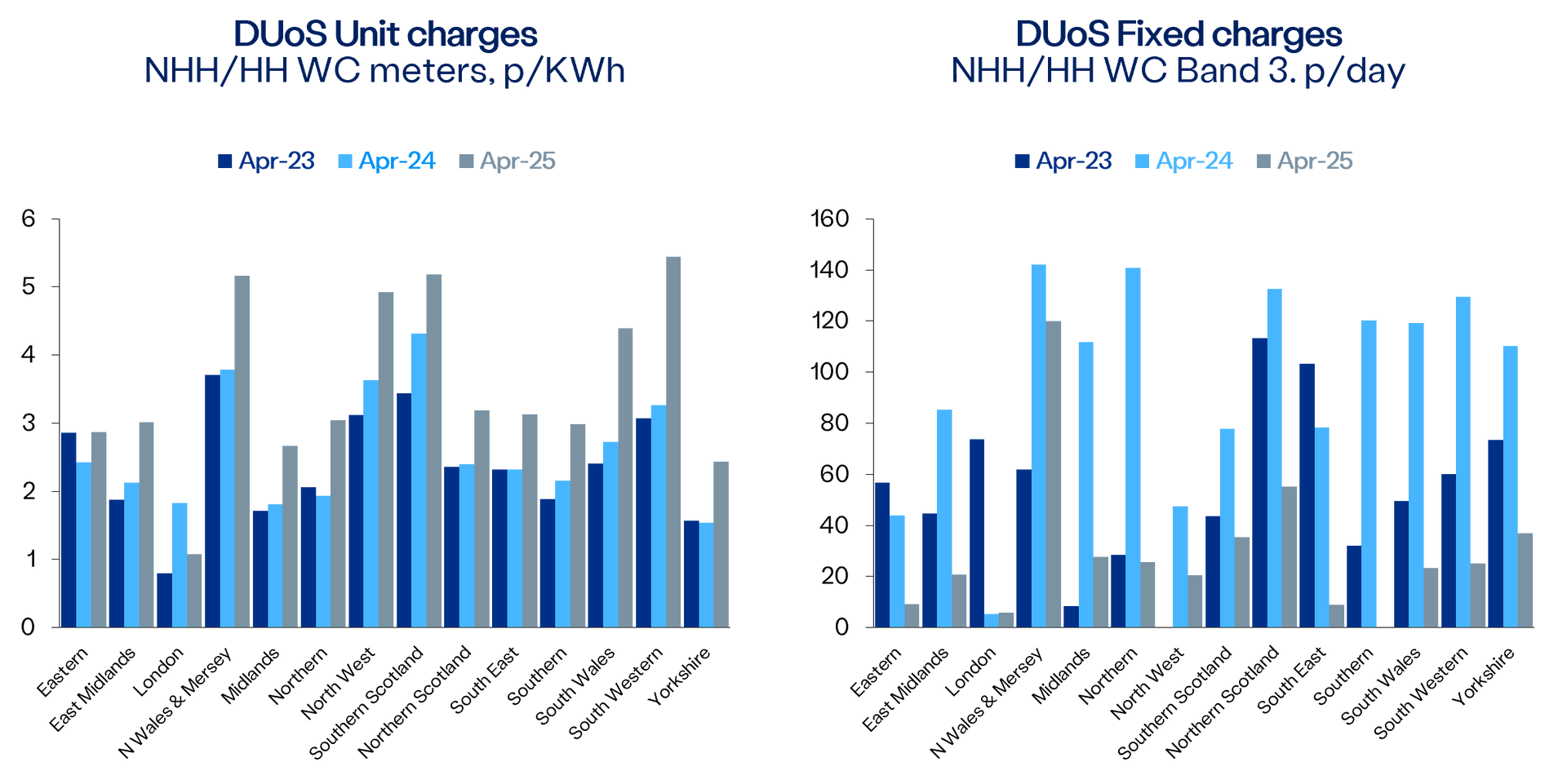

DUoS charges are published 18 months in advance of the charging year, and as such the 2025/26 final rates for DUoS have now been released. Movements from 2024/25 rates will vary between network operators, but generally the consumption-based and capacity-based charges have seen notable increases whilst the fixed p/day charges are seeing sizeable reductions.

The level of charge a site incurs will vary by region, meter/voltage type and consumption band, below is a demonstration of DUoS movements across the regions for a non-half hourly or whole current half hourly meter in consumption band 3.

Transmission Network Use of System (TNUoS)

TNUoS charges are a cost to transmission connected generators and suppliers. These charges cover the cost of installing and maintaining the transmission system in the UK and offshore (16).

National Grid ESO has issued a Draft TNUoS Tariff for 2024/2025, resulting in minimal movements from the 2023/24 charging year.

Balancing Services Use of System (BSUoS)

BSUoS charges are set up to recover the costs of balancing the system. This means the real time balancing of supply and demand on the electricity grid. It takes into consideration, generation imbalance, unforeseen outages and system constraints.

April 2023 saw two significant changes to the BSUoS charge:

- CMP308 – the cost of BSUoS moved from split between generators and suppliers to suppliers only, effectively doubling the supplier bill.

- CMP361 – introduction of ex ante fixed BSUoS rates for 6 monthly periods, published 15 months in advance, providing greater certainty for suppliers around BSUoS rates.

- The table to the right shows the published BSUoS rates to date, though it is important to note that if BSUoS costs exceeds the published rates for the period by a set tolerance, then National Grid are entitled to ‘re-open’ the rate to ensure they recover. As a result, some suppliers are still applying their own forecasted rates to mitigate the risk of this eventuality.

Contracts for Difference (CfDs)

According to the Department for Security and Net Zero (DESNZ), the government is looking to introduce a CfD Sustainable Industry Reward. The reward is set to accelerate deployment of low carbon electricity generation through offshore wind (18).

This reward scheme is proposed to take place from CfD Allocation Round 7 onwards.

As a result, it is expected that this would generate more revenue support to projects that take action to increase economic, environment and social sustainability of offshore and floating offshore wind.

Energy Intensive Industries(EII) Levy

Early 2023 saw the introduction of the British Industry Supercharger (BIS) (19). The BIS is set to make Energy Intensive Industries (EII) more internationally competitive as well as address the carbon leakage.

One of the important aspects of the BIS is the proposal of a compensation scheme for the charges paid for using the GB electricity grid through the EI Network Charging Compensations (NCC) Scheme.

Once an EII acquires an eligible exemption certificate, they will receive 60% compensation on eligible network charging costs. As funding is being raised for the EII support levy, the NCC compensation will be paid out 12 months in arrears.

According to the Department of Business and Trade, the operation of schemes is as follows:

- April 2024: Network costs eligible for compensation from 1st April

- April 2025: Commence of NCC Scheme and EII Support Levy

- April 2025: Monthly levy obligation to cover compensation for April 2024 network costs

- July 2025: EIIs compensated for April-June 2024 network costs (subject to administrator)

Sources & Notes:

15)Gas and electricity indicative cost stacks are based on portfolio averages for SMEs over a 60-month period. Excludes taxes, operating expenses, margins and broker fees

16)Draft TNUoS Tariffs for 2024/25,, National Grid ESO, November 2023, 2024-25 Draft TNUoS Tariffs Report [Published] (nationalgrideso.com)

17)Balancing Services Use of System (BSUoS) charges, National Grid ESO, Balancing Services Use of System (BSUoS) charges | ESO (nationalgrideso.com)

18)Introducing a Contracts for Difference (CfD) Sustainable Industry Reward, Department for Energy Security and Net Zero, 16 November 2023, Introducing a Contracts for Difference (CfD) Sustainable Industry Reward - GOV.UK (www.gov.uk)

19)Consultation Outcome: Government response: British Industry Supercharger Network Charging Compensation Scheme, Department for Business & Trade, 11 October2023 Government response: British Industry Supercharger Network Charging Compensation Scheme - GOV.UK (www.gov.uk)