Encouraging signs for businesses, yet growth remains slow. Concerns over and impact of energy prices are subsiding

Three prominent business sentiment surveys indicate that UK bosses are much more optimistic about 2024 than last year.

According to The British Chambers of Commerce (BCC) quarterly economic survey (the UK’s largest and longest-running independent business survey) business confidence improved in Q4’23 with 56% of bosses expecting an increase in turnover in the next 12 months, up from 53% in the previous quarter (1).

Business confidence index is at its highest level since Q1’22, when Covid restrictions were lifted.

Meanwhile, PwC’s 27th annual CEO survey revealed that UK chief executives are significantly more optimistic about the prospects for the economy this year than they were a year ago (2).

CEOs were deeply concerned with the state of the UK economy last year with only 9% expecting an improvement. However, the percentage of respondents expressing more optimism for 2024 rose to 39%. PwC said that the improved confidence may partly explain why 53% of CEOs expect to make at least one major acquisition in the next three years, whereas just 24% said they made an acquisition in the previous three years.

Sentiment among UK finance chiefs has also improved. The latest Deloitte CFO Survey shows a more optimistic trend emerging with confidence rising for the second consecutive quarter (3).

Growing confidence in the economy and a more positive outlook for businesses is likely driven in large part by a more stable macroeconomic and political environment than a year ago.

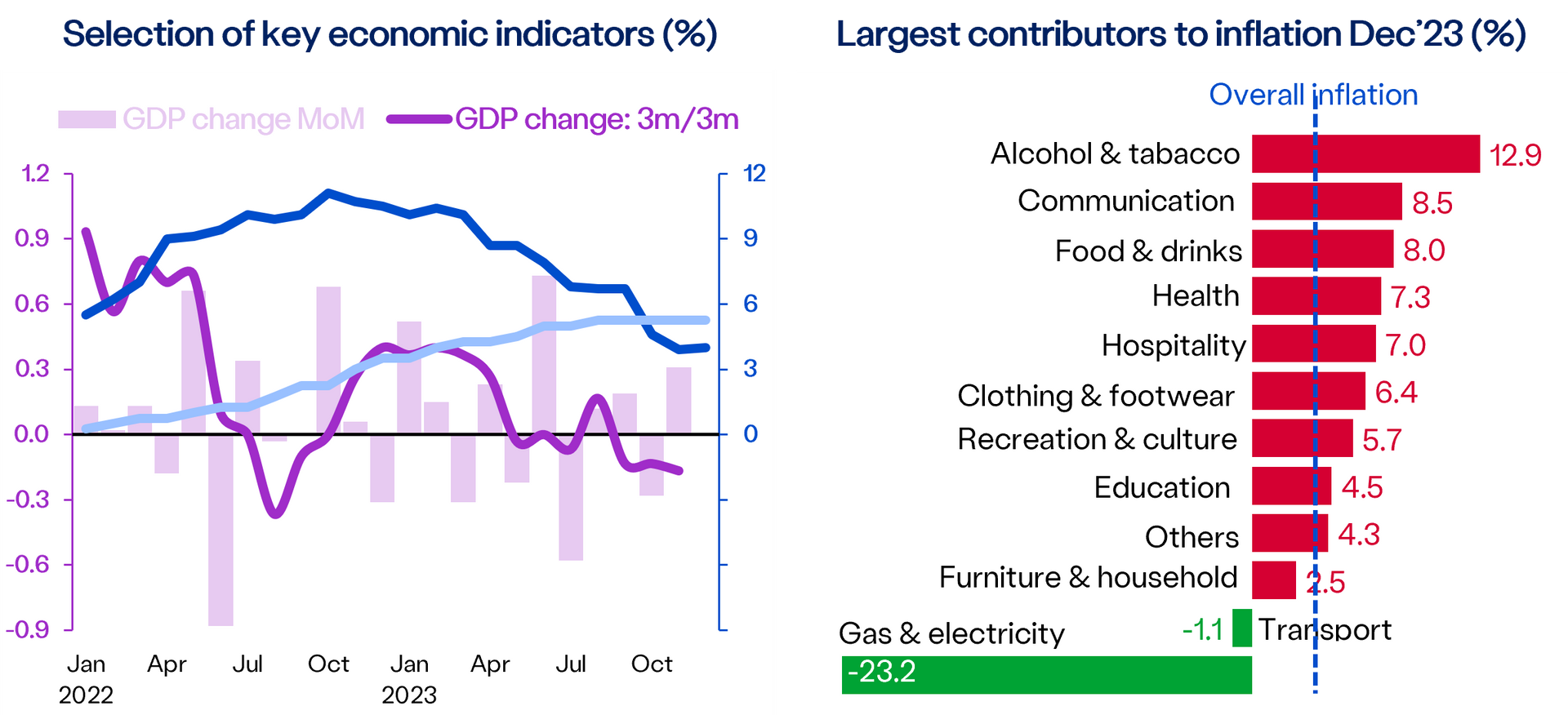

The rate of inflation has been easing throughout 2023, and as a result, the Bank of England paused its most aggressive series of interest rate increases in decades. Following 14 consecutive rate hikes, the Bank set rates at 5.25% in August 2023 and has not changed them since then.

With inflation cooling, largely driven by lower energy prices, and weak economy growth, economists are predicting a possible rate cut in May or June (4).

However, whilst it is encouraging to see business leaders feeling more optimistic about the future, economic growth remains fragile.

According to the Office for National Statistics (ONS), Gross Domestic Product (GDP) expanded by 0.3% in November, but this followed an unexpected decline of 0.3% In October (5).

As a result, growth shrank by 0.2% in the three months to the end of November. A contraction or flat output in December, could tip the economy into a technical recession - defined as two consecutive quarters of negative growth.

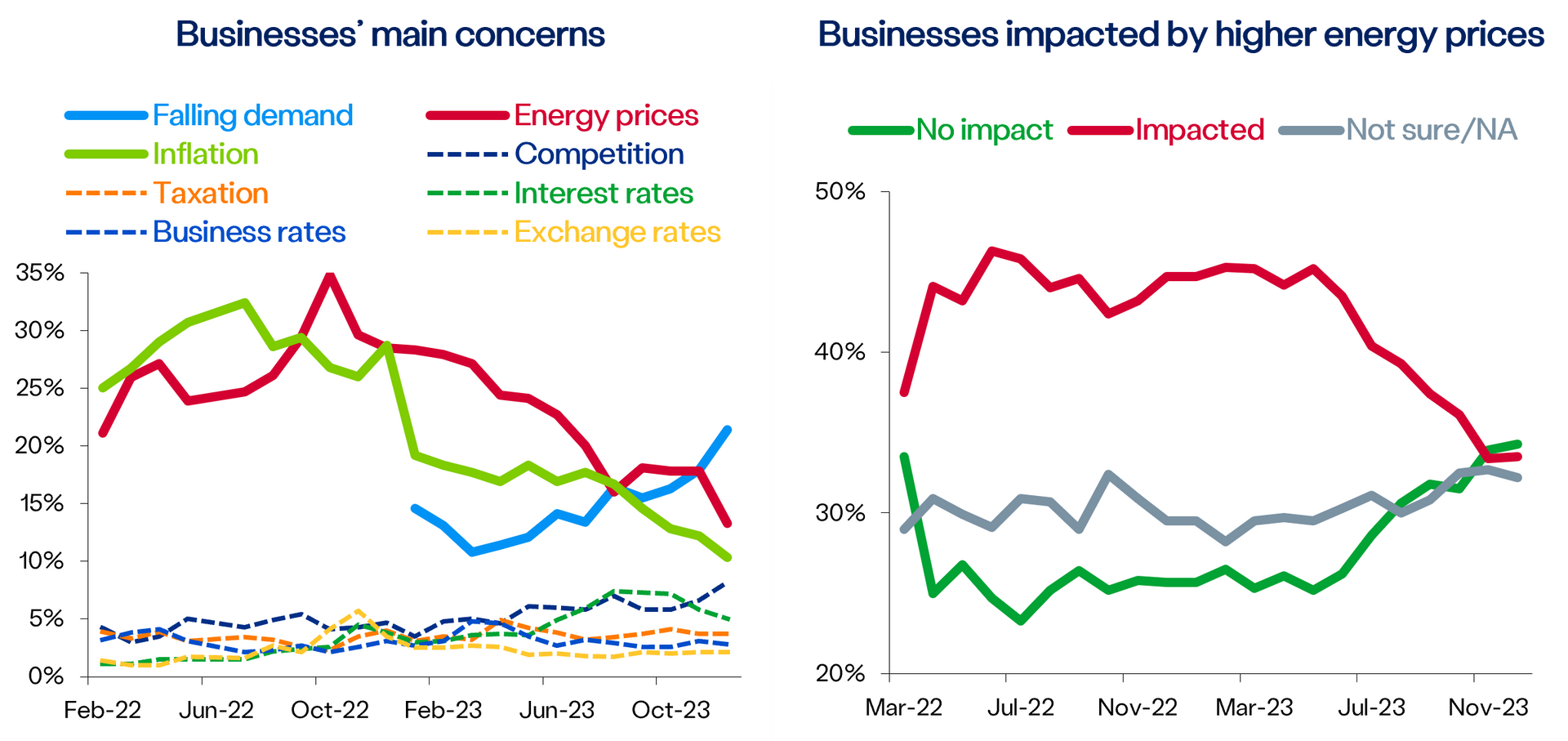

Concerns over and impact of energy prices on businesses at their lowest

The number of companies with 10 or more employees reporting being concerned about energy prices has fallen to its lowest level since early 2022, when the ONS Business Insights and Conditions Survey began asking this question (6).

Falling demand has become the top concern for businesses, whilst inflation, like energy costs, has also declined in importance.

With wholesale energy prices returning to the levels pre-Russia-Ukraine conflict during 2023, fewer businesses are reporting being affected by energy costs (6).

In fact, there are now more businesses stating that they have not been impacted by energy prices than those who say they have.

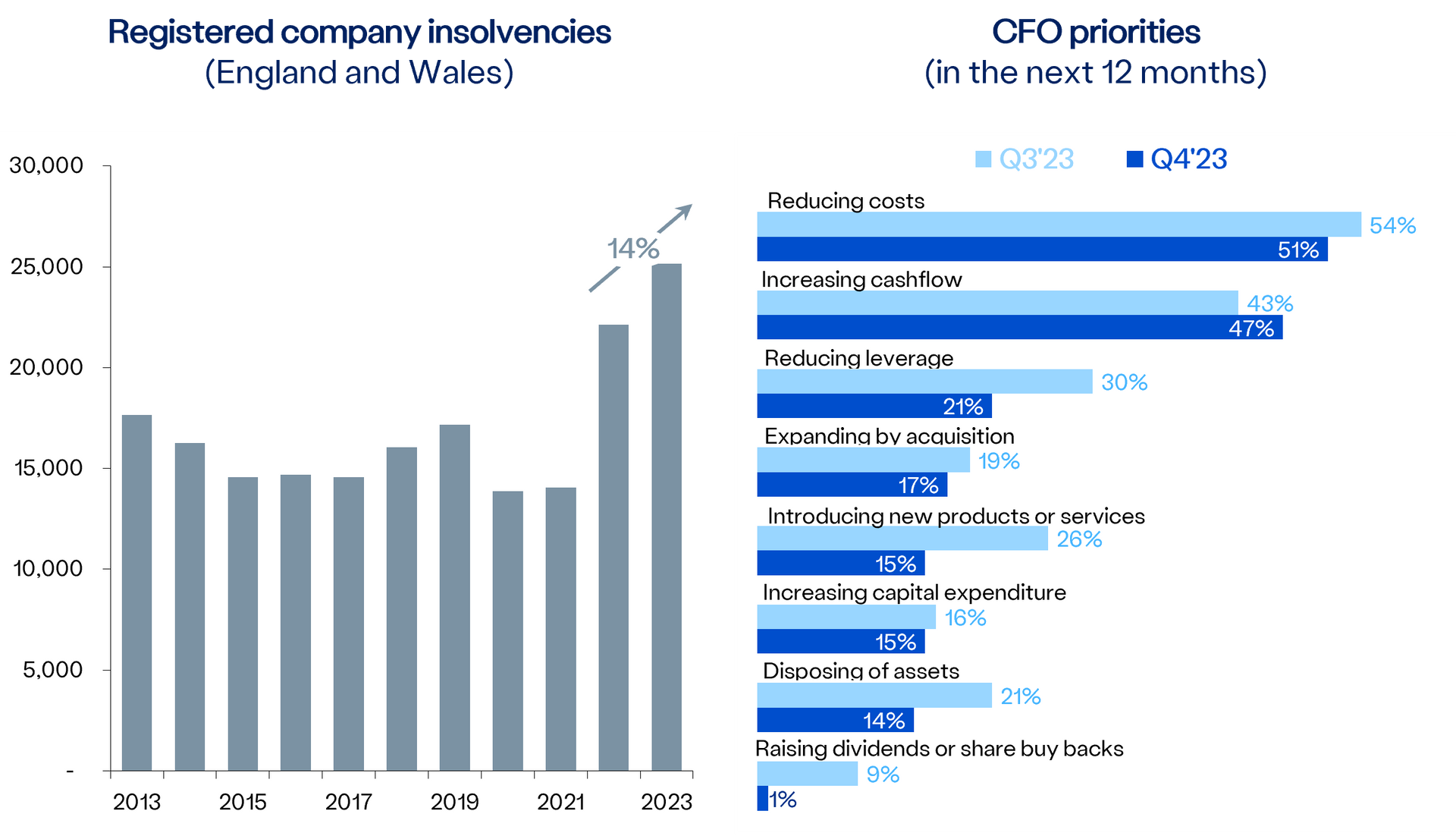

High energy costs was the largest contributor to inflation at some point and for many months in 2023. Coupled with other costs of doing business (including taxation, employment costs, supply chain issues, etc.), put significant pressure on companies and many could not continue trading.

In 2023, just over 25k companies were declared insolvent in England and Wales (7). Whilst these numbers will be revised and adjusted for seasonal variations, insolvencies hit its highest level since 2009.

Small businesses accounted for the bulk of insolvencies as larger companies are generally better able to manage periods of stress.

According to business consultants Deloitte, “large corporates tend to have stronger balance sheets, more diversified sources of income and are less vulnerable to tightening conditions than small businesses” (3).

The bottom line is that business leaders remain focussed on reducing costs and building up cash.

Sources & Notes:

1)The British Chambers of Commerce (BCC) Q4 2023 Economic Survey, BCC 3 January 2024 https://www.britishchambers.org.uk/news/2024/01/bcc-quarterly-economic-survey-business-confidence-boost-fails-to-revive-investment/

2)PwC 27th UK CEO Survey, PwC 15 January 2024 https://www.pwc.co.uk/ceo-survey.html

3)A positive start to 2024: Deloitte CFO Survey Q4 2023, Deloitte 8 January 2024 https://www2.deloitte.com/uk/en/pages/press-releases/articles/deloittes-q4-cfo-survey-cfos-start-the-new-year-in-positive-spirits.html

4)Interest rate cuts still expected despite UK inflation uptick, BBC 17 January 2024 https://www.bbc.co.uk/news/business-67993276

5)GDP monthly estimate: November 2023, Office for National Statistics (ONS) 12 January 2024 https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/november2023

6)Business insights and impact on the UK economy Wave 99, Office for National Statistics 11 January 20234https://www.ons.gov.uk/businessindustryandtrade/business/businessservices/bulletins/businessinsightsandimpactontheukeconomy/latest

7)Company insolvencies on track for 14-year annual high after December rise, The Independent 16 January 2024 https://www.independent.co.uk/business/company-insolvencies-on-track-for-14year-annual-high-after-december-rise-b2479530.html