Wholesale energy prices are rising again having bottomed out in June

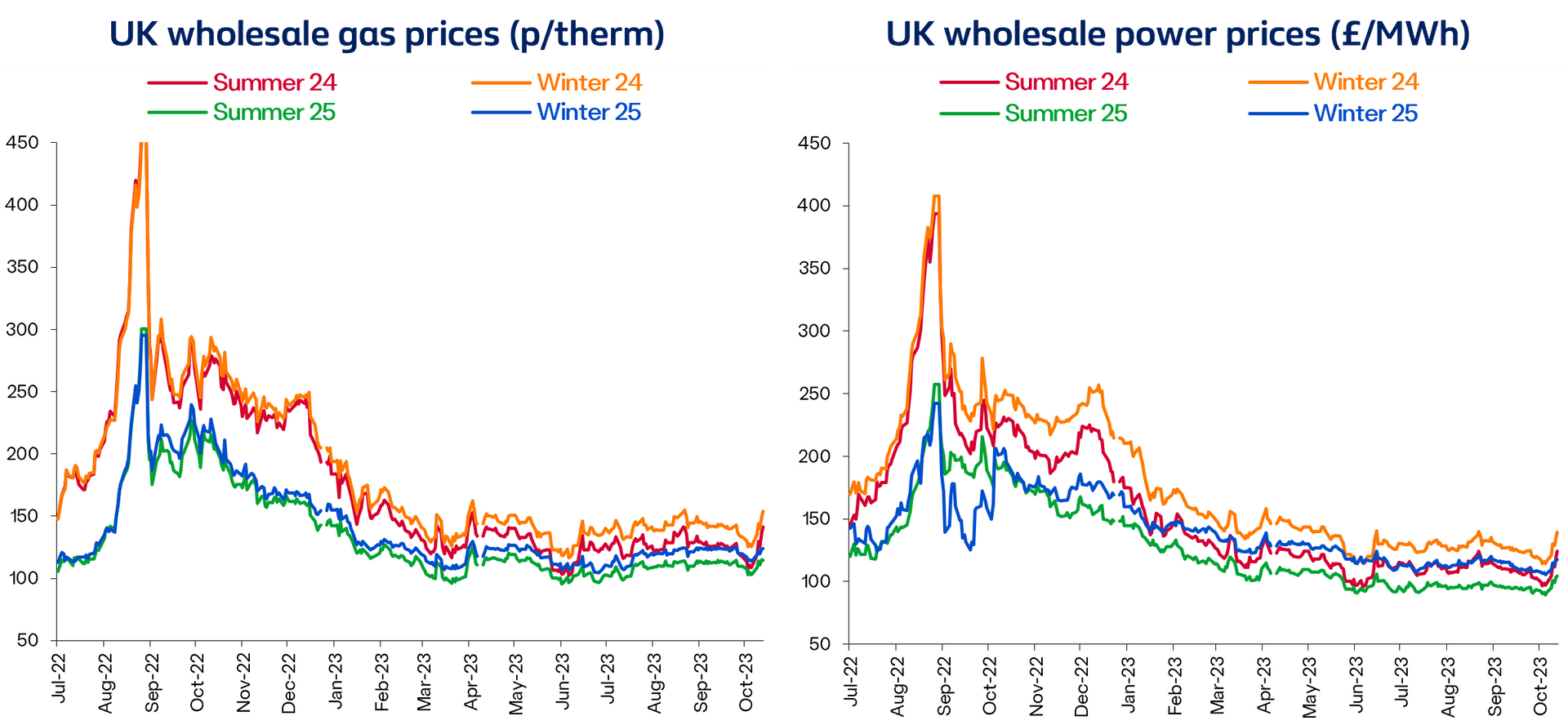

In the first six months of 2023, wholesale gas and electricity prices had been on a downwards trajectory. Indeed, season ahead (Summer 24) prices bottomed out in early June at 102p/therm and £96/MWh respectively (12).

Prices then fluctuated within a tight range between the end of June and early October before rising sharply by 30% by the middle of October to 141p/therm for gas and £124/MWh for power.

Despite these recent price increases, gas and power prices are down by 23% and 29% respectively year to date.

The return of higher prices and volatility during Q3 can be explained in three main acts:

Act 1: Prices stubbornly high in July despite high levels of gas storage

In July, gas prices saw upward momentum on the back of maintenance work carried out in Norway (which reduced pipeline deliveries) and in the USA (which reduced Liquified Natural Gas (LNG) output).

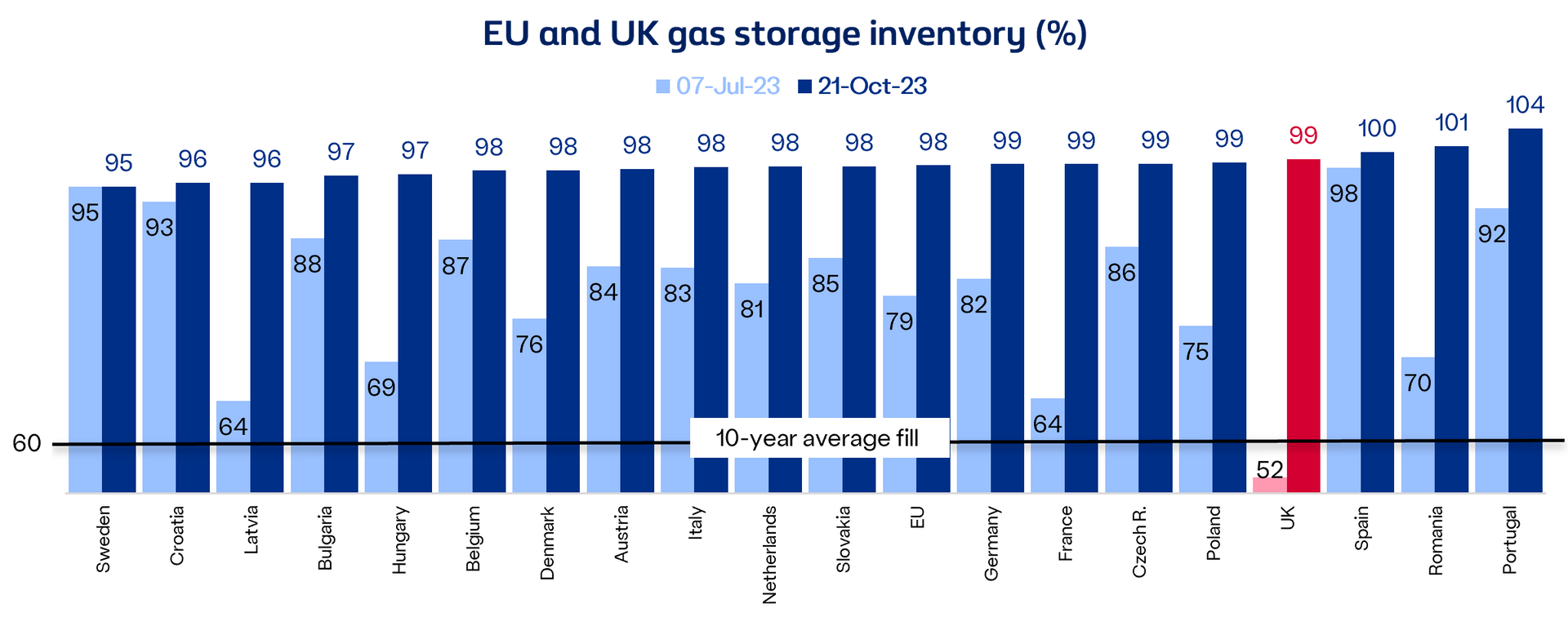

Prices remained stubbornly high, even though gas inventories across Europe were significantly high compared to the 10-year average fill and on track to reach the 90% capacity target by 1 November 2023 (13).

Although gas imports from Russia into Europe have virtually been replaced by supplies from Norway and LNG from around the world including the USA, “energy markets remain generally tight on the lack of Russian gas” says the head of commodities at Investec (14).

Act 2: Prices soared in August on Australia supply disruption fears

In early August, reports about potential disruptions to LNG supplies from Australia due to industrial action at two major gasification facilities sent markets sharply higher.

Traders were reacting to concerns that a drop in shipments would increase competition for LNG, forcing Asian buyers to outbid European buyers to attract LNG cargoes (15).

The Australian LNG industrial action saga over pay and conditions continued for much of August feeding volatility in the gas market while the situation was unresolved.

Meanwhile, higher gas storage levels continued to provide a buffer for extreme price spikes.

Act 3: September was the calm before the storm

Strike action finally took place at Chevron's Gorgon and Wheatstone plants in Western Australia in early September.

However, the impact was moderate with Summer 24 prices remaining broadly flat in the ensuing days and weeks.

By late September, Chevron and the unions struck a deal to end the strikes, and, consequently, wholesale prices softened and continued falling until the end of the first week of October.

The weather also contributed to the decline with temperatures well above seasonal norms in September and into October, delaying gas needs for heating.

Forward curves show modest impact of Middle East crisis on future prices

Despite the nervousness in the market ahead of winter, forward curves generated in mid-October have not varied significantly when compared to those generated back in early July. The futures market continues in contango, with near term prices generally higher than prices further down the curve (16).

Gas and electricity prices have fallen from previous highs but remain above pre-Covid levels.

There are two main reasons:

- The UK’s dependency on gas for power generation is expected to remain broadly unchanged

Europe depends more on international LNG to replace Russian gas

According to Cornwall Insight, prices will peak in 2024 and then start to drop as higher marginal cost fuelled technologies are displaced by new renewables (technologies) including new offshore turbines to meet the government’s 2030 wind generation target (17).

The low marginal cost of wind turbines means that when they are generating, prices tend to fall.

- The UK’s dependency on gas for power generation is expected to remain broadly unchanged

- Europe depends more on international LNG to replace Russian gas

According to Cornwall Insight, prices will peak in 2024 and then start to drop as higher marginal cost fuelled technologies are displaced by new renewables (technologies) including new offshore turbines to meet the government’s 2030 wind generation target (17).

The low marginal cost of wind turbines means that when they are generating, prices tend to fall.