Wholesale energy market update: There and back again

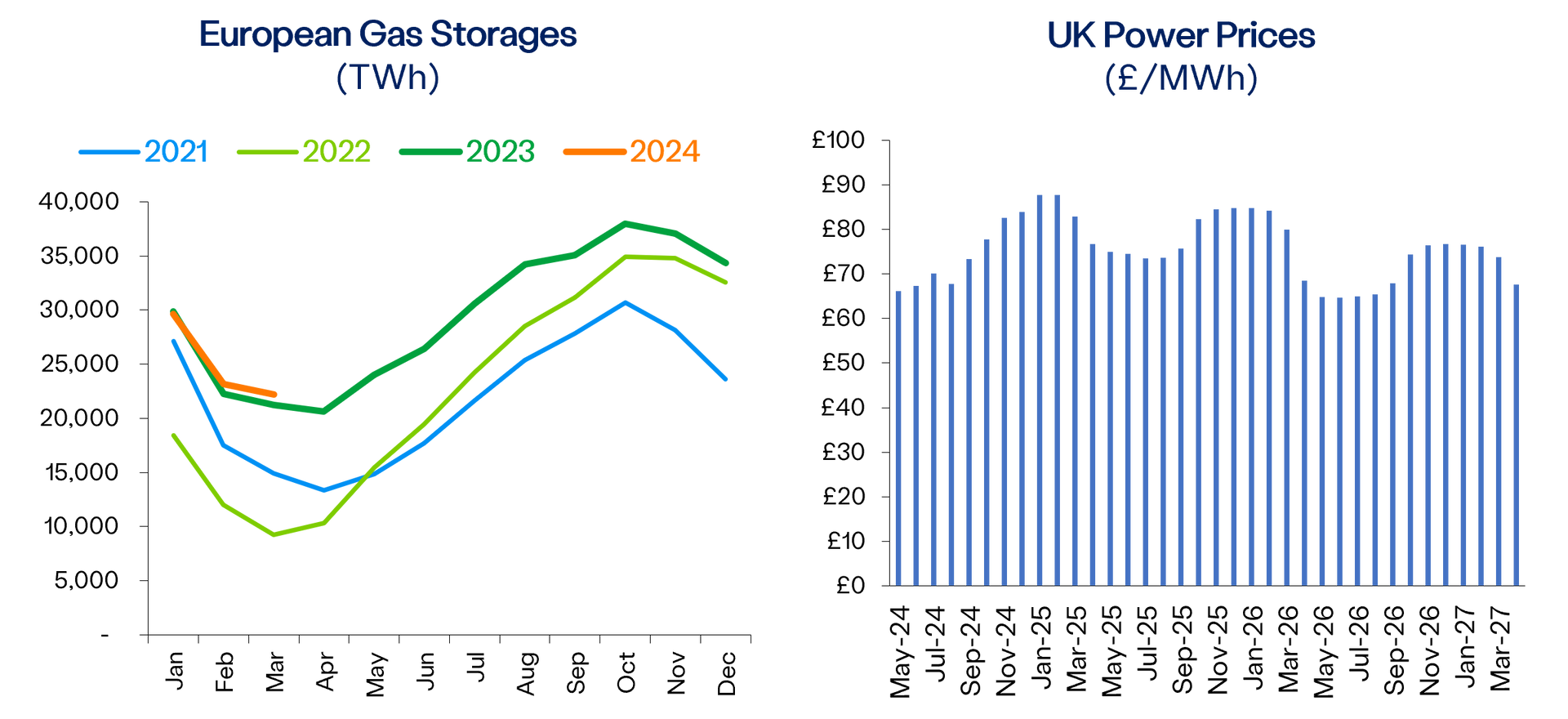

Wholesale energy markets over the first quarter of 2024 continued their downward trajectory, as fears of a cold winter subsided, UK and European gas storage facilities remained well stocked, and LNG cargos continued to arrive in Europe (1 & 2).

As the year has progressed, however, we have seen Ukraine attack Russian oil refineries, Russia strike Ukrainian gas storage facilities, a variety gas of supply outages across Europe, and increased demand for LNG in Asia.

Despite bumper storage levels UK and European energy markets are pricing-in significant risk premiums for the season’s ahead, as uncertainty in the medium-term global commodity markets, and geo-political situation prevail.

Over the quarter we have seen energy prices fall by 30% and then rise back again, as the market sobers to the prospect of prolonged conflict in the Middle East and Red Sea, and Ukrainian and Russian energy supply and storage facilities appear increasingly vulnerable to strikes.

While we are unlikely to see the price levels observed in 2022 this summer, the energy market has been exposed to similar levels of volatility.

LNG supply constrained in Europe

The LNG market plays an important role in setting the marginal price of Natural Gas in Europe, due to its flexibility to offer spot supply across the globe.

Over the quarter exports from the United States into Europe fell, in response to heightened Asian demand. Likewise, more cargos from the Middle East have been drawn to Asian markets as they seek to avoid the risks of taking cargos to Europe via the Red Sea and the costs via the Cape of Good Hope. This has led to a reduction in LNG imports to the UK by 44% last quarter as compared to the previous year (3).

Despite exiting the winter with ample storage stocks forward curves future gas and power prices have risen

While LNG has constrained supply in addition to 22 unplanned outages effecting European gas facilities (4) the supply fundamentals are otherwise good for this season with European storages 47% more full than the previous 3-year average (5).

Despite this future prices have risen in reaction to in response to the dynamic geo-political situation in the Middle East and from the Russo-Ukrainian War. Consequently, gas market prices for the Q2-2025 carry an 11% premium compared to the equivalent monthly Q2-2024 products. (6)

Sources:

1)ICE UK NBP Gas Futures, 17 April 2024

2)ICE UK Baseload Power Futures, 17 April 2024

3)UK Monthly Imports, Refinitiv, 18 April 2024

4)Gas Outages, Refinitiv, 18 April 2024

5)Daily Stock Levels (GSE), Refinitiv, 18 April 2024

6)Argus Quoted Mid Market NBP Market Prices, 17 April 2024