Businesses are more optimistic about the economy and less concerned over energy prices. However, sluggish growth exerts pressure on fragile firms.

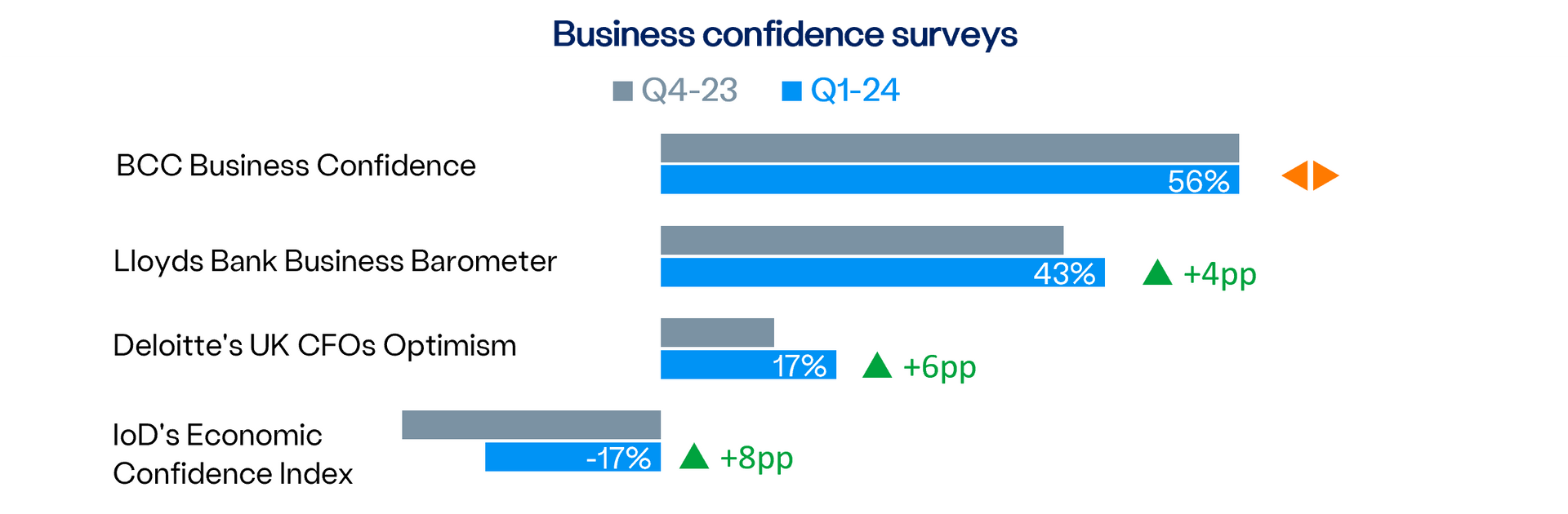

Business sentiment over prospects for the year ahead is more optimistic, with three out of four major confidence surveys showing improvements in Q1-24 compared to the last three months of 2023.

The British Chambers of Commerce (BCC) quarterly economic survey (the UK’s largest and longest-running independent business survey) reported no improvement in business sentiment this quarter, with confidence remaining unchanged at 56% (1). However, at 56% confidence is at its highest point since Q1-22. The BBC survey measures confidence by the number of businesses expecting an increase in turnover in the next twelve months.

Another closely watched business survey, Lloyds Bank Business Barometer, showed confidence ending the first quarter of the year 4pp higher, at 43%, than the previous quarter (2). Lloyds Bank’s confidence index fluctuates month on month, but it has been on an upwards trajectory since dipping below its long-term average of 28% last December.

Optimism among UK finance chiefs has also improved. The latest Deloitte CFO Survey shows a shift in sentiment, up 6pp to 17% in Q1-24 (3).

The uncertainties that have clouded the financial prospects for their companies seem to be clearing.

The largest increase in optimism has been reported by the Institute of Directors (IoD) Economic Confidence Index, which took a significant leap forward of 8pp over the previous quarter to end at -17% (4).

The IoD’s index is based on the net answers to the question of how optimistic are their members about the wider UK economy over the next 12 months. The index remains in negative territory but it’s clear that directors are more hopeful about the future and the poll figures support the argument in favour of emerging economic green shoots.

Consumers too are feeling more confident about the future than in the past 18 months, according to Deloitte Consumer Tracker (5). Consumer confidence increased slightly by 0.5pp in Q1-24, although marginal, it was the sixth consecutive quarter of continued improvement.

Growing confidence in the economy and a more positive outlook is likely driven in large part by a more stable macroeconomic environment.

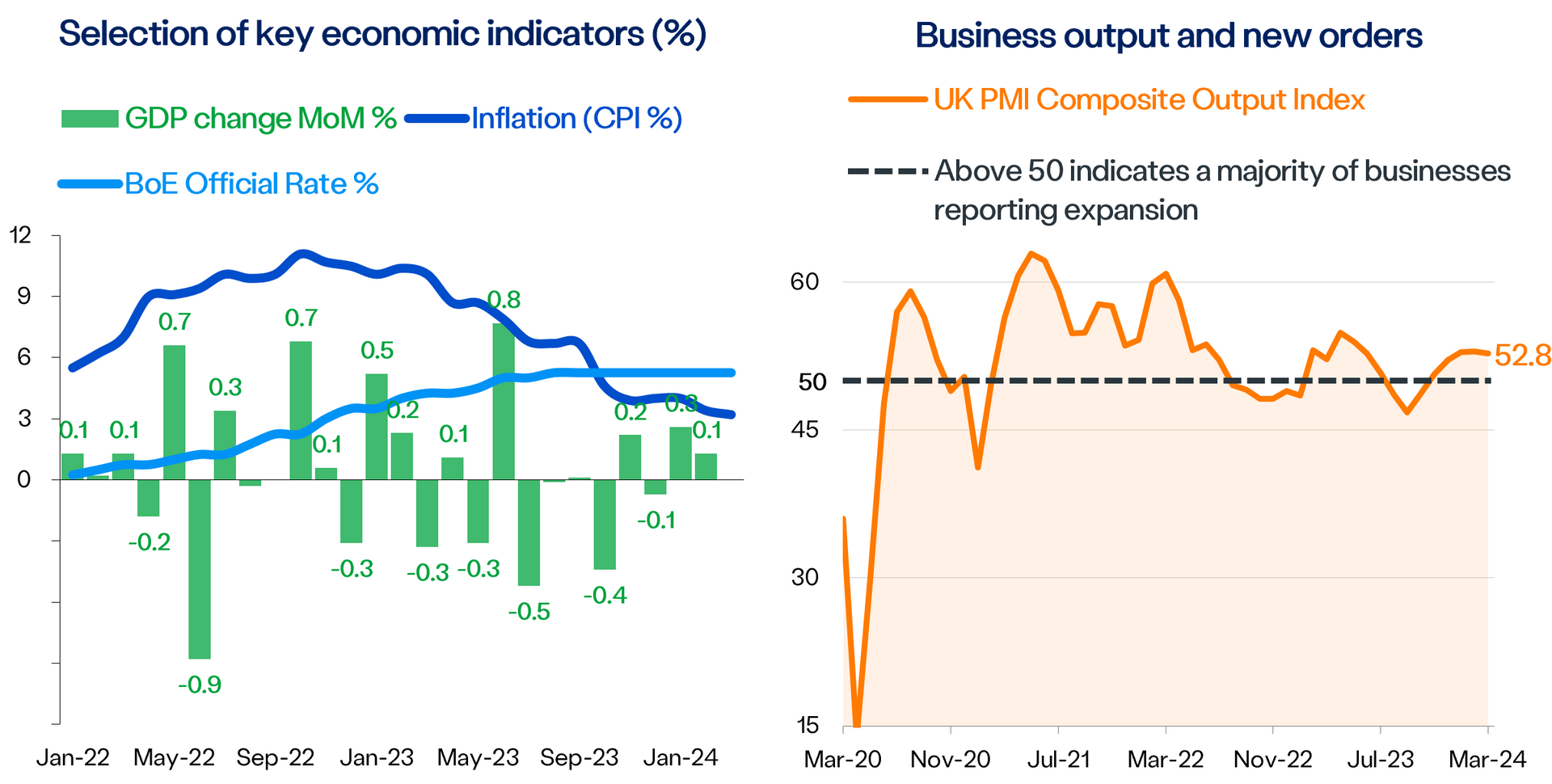

After peaking at a 41-year high of 11.1% in October 2022, inflation (the change in consumer prices over the past 12 months) fell to 3.2% in March from 3.4% and 4% in February and January respectively (6). This was the lowest rate since September 2021, when inflation was on the way up.

Lower energy prices as well as slower increases in food and drink prices compared to a year ago were the main drivers.

Inflation is expected to continue falling with the Bank of England (BoE) as well as economists forecasting the rate to fall below 2% in the second quarter, likely driven largely by the reduction in Ofgem’s energy price cap, before rising back towards 3% (7 & 8).

With inflation falling, financial markets have become more confident that interest rates could be cut in the coming months. The BoE has kept interest rates unchanged at 5.25% since August 2023 – the highest rate since 2008 (9).

However, the timing of interest rate cuts could be delayed by unexpected supply chain disruptions resulting from recent tensions in the Middle East and another energy price shock, even if a mild one (10).

With confidence returning, business activity, both manufacturing and services, showed strong end to the first quarter with output expanding in March for the fifth consecutive month (11).

Although March economic growth figures are yet to be released, the UK Purchase Managers’ Index (PMI) for the month is very encouraging and signals a solid rebound from the technical recession seen in the second half of 2023. Month-on-month gross domestic product (GDP) grew by 0.3 and 0.1 in January and February respectively (12).

The government has claimed that these economic indicators showed that “the plan is working”, with both the Prime Minister and more recently the Chancellor, both declaring that the UK “has turned the corner” (13).

However, The International Monetary Fund (IMF) has downgraded its UK growth forecast for 2024 and now expects the economy to increase by just 0.5% this year and 1.5% in 2025 (14).

Whilst optimism is on the rise, a period marked by exceptionally high inflation, an energy crisis, labour shortages, supply chain disruptions, raising interest rates, decline in demand and the tail end of Brexit-related issues and Covid-19, has had a profound impact on businesses.

Sluggish growth is likely to exacerbate the cost of doing business to levels not affordable for many businesses. According to a report by Allianz Trade, the UK has the highest proportion of “fragile firms” out of all major European economies (15).

About 15% of small and medium-sized enterprises (SMEs) in the UK are at risk of defaulting on their debts over the next four years, That’s above France at 14%, Italy at 9% and Germany at 7%.

Allianz Trade estimates that insolvency rates will peak in 2024 with insolvencies rising by 10% year-on-year to 31,000. Although insolvencies are likely to decline in 2025, it will remain high by historical standards.

Given the challenges of recent years and what is expected for the reminder of 2024, it is perhaps unsurprising that, for all the good news, businesses remain focussed on reducing costs (3).

Whilst businesses are planning to pursue some expansionary strategies, such as acquisitions, introducing new products or expanding into new markets, their intentions to invest in equipment, machinery or new plants have fallen to the lowest level in three-and-half years.

Geopolitical uncertainty seen as the greatest risk, whilst concerns over energy prices at their lowest level

Businesses are increasingly sighting geopolitical uncertainty as the biggest economic risk, which could cloud the picture for global trade and weaken the already downgraded projections for growth (3).

In addition to the uncertainty generated by the conflicts in Ukraine and the Middle East, with their unpredictable twists and turns, in 2024 almost half of the world’s population will go to the polls in an unprecedented super election year. With so many elections in one year, businesses are concerned about heightened polarisation and the risk of civil unrest, including in Western democracies.

According to a report by Allianz Commercial, political risk and violence ranked as the eighth-largest worry for companies globally in 2024, up from 10th in 2023 and 13th in 2022 (16). Allianz Commercial notes that “the last time it ranked so high was 2017, amid the uncertainty of the Brexit vote in the UK and the election of Donald Trump as president in the USA.”

Meanwhile, concerns about energy prices have dropped significantly from business leaders’ list of worries. Both, Deloitte CFO Survey and the Office for National Statistics Business Insights study, reported that worries over energy prices have fallen to their lowest level (3 & 17).

Sources:

1)The British Chambers of Commerce Q1 2024 Economic Survey, 11 April 2024 https://www.britishchambers.org.uk/news/2024/04/bcc-quarterly-economic-survey-firms-treading-water-on-investment/

2)Lloyds Bank Business Barometer March 2024, 27 March 2024 https://www.lloydsbankinggroup.com/media/press-releases/2024/lloyds-bank-2024/march-2024-business-barometer.html

3)Turning the corner: Deloitte CFO Survey Q1 2024, April 2024 https://www2.deloitte.com/uk/en/pages/finance/articles/deloitte-cfo-survey.html

4)Tentative signs of economic green shoots as business confidence rises: Institute of Directors’ Economic Confidence Index, 1 April 2024 https://www.iod.com/news/uk-economy/iod-press-release-tentative-signs-of-economic-green-shoots-as-business-confidence-rises/

5)Consumer confidence reaches new two-year high amidst improving personal finances, Deloitte Consumer Tracker, 19 April 2024 https://www2.deloitte.com/uk/en/pages/press-releases/articles/consumer-confidence-reaches-new-two-year-high-amidst-improving-personal-finances.html

6)Consumer price inflation March 2024, Office for National Statistics 17 April 2024 https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/march2024

7)When will we get back to low inflation?, Bank of England 21 March 2024 https://www.bankofengland.co.uk/explainers/will-inflation-in-the-uk-keep-rising

8)UK Economic outlook, KPMG March 2024 https://kpmg.com/uk/en/home/insights/2018/09/uk-economic-outlook

9)Official Bank Rate history, Bank of England https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp

10)Flash PMI shows strong end to first quarter for UK economy, S&P 21 March 2024 https://www.spglobal.com/marketintelligence/en/mi/research-analysis/flash-pmi-shows-strong-end-to-first-quarter-for-uk-economy-but-inflation-still-looks-sticky-Mar2024.html

11)BOE’s Megan Greene Says UK Interest Rates Cuts ‘Not Imminent’, Bloomberg 18 April 2024 https://www.bloomberg.com/news/articles/2024-04-18/boe-s-megan-greene-says-uk-interest-rates-cuts-not-imminent

12)GDP monthly estimate: February 2024, Office for National Statistics (ONS) 12 April 2024 https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/february2024

13)Chancellor Jeremy Hunt insists UK's economy has 'turned corner’, Sky News 17 April 2024 https://news.sky.com/story/chancellor-jeremy-hunt-insists-uks-economy-has-turned-corner-telling-public-to-stick-to-plan-for-better-times-13117376

14)UK growth forecast downgraded by IMF, Financial Times 16 April 2024 https://www.ft.com/content/47200602-d516-4312-a146-e011e937edef

15)Rocky road ahead as UK insolvencies set to peak, Allianz Trade 11 March 2024 https://www.allianz-trade.com/en_GB/insights/economic-research/2024-uk-insolvency-outlook.html

16)Managing the increasing threat of political violence and civil unrest, Allianz Commercial April 2024 https://commercial.allianz.com/news-and-insights/reports/political-violence-and-civil-unrest-trends.html

17)Business insights and impact on the UK economy Wave 102, Office for National Statistics 18 April 2024 https://www.ons.gov.uk/economy/economicoutputandproductivity/output/datasets/businessinsightsandimpactontheukeconomy