What businesses pay for their energy

With more uncertainty ahead, it’s vital that businesses understand what they pay for their energy.

During the last quarter of 2020 energy costs continue to increase, albeit at a slower pace than the previous two quarters.

This time, wholesale costs (the cost of purchasing the energy in the wholesale markets) increased faster than any other single cost.

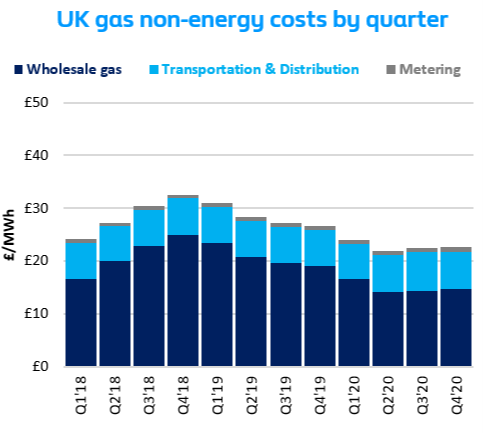

On the other hand, non-energy costs (also known as third party costs that cover the cost of maintaining the system and environmental charges) decreased for the second quarter in a row.

As a result, non-energy costs accounted for 60% and 35% of a typical business electricity and gas bill respectively in Q4’2020 (3).

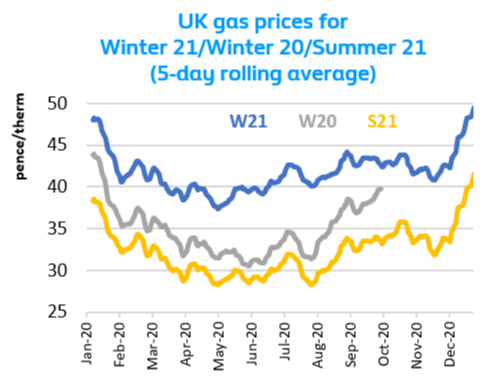

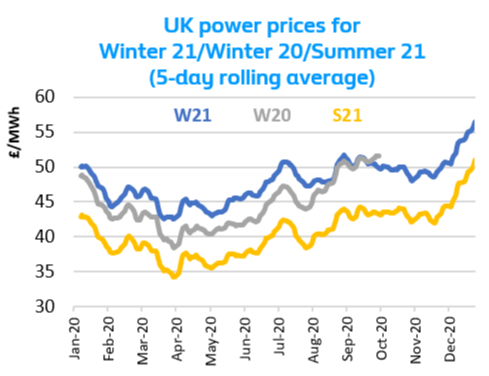

Wholesale energy prices have continued to rise since the Spring, despite a dip in November as a result of the second lockdown.

Prices have recovered strongly through to the end of 2020 in response to a recovery in energy demand, the impact of unusual weather (low temperatures and low wind generation) which has forced the power system operator to encourage traditional generators to produce more electricity to balance the system and a global race for securing gas supplies (LNG for instance), particularly from Asian buyers.

UK power and gas prices for Summer 21 increased by 22% and 12% respectively in 2020 (4).

Non-energy costs remained broadly flat quarter-on-quarter. However a quarterly average conceals significant variation across individual costs (3).

Most non-energy costs are fixed at the start of the year and some are set over a year in advance except for BSUoS (Balancing Services Use of System), CfD (Contract for Difference) and FiT (Feed in Tariff) which can change within the year.

The BSUoS charge recovers the cost of day-to-day operation of the transmission system. Generators and suppliers are liable for these charges which are calculated by National Grid based on the balancing actions taken to manage the system.

The fall in power demand as a result of the Covid-19 lockdowns and actions to curtail high renewables output in the Spring and Summer led to a sharp rise and volatility of BUSoS charges. To provide more certainty, a number of modifications were implemented to cap and defer the charges. These have stabilised BSUoS but then we saw National Grid ESO issued a record number of alerts for tight margins in November and December. Suppliers are responding to this by placing higher risk premium on their BSUoS pricing.

The CfD scheme supports the generation of large scale, low carbon electricity such as offshore wind farms. It is the only subsidy scheme for renewables that is still open for new entrants so is the fastest growing renewable levy. The Low Carbon Contracts Company (LCCC) administers the scheme and pays the difference between the strike price and wholesale market price as a subsidy to generators.

Following the first lockdown, revenues available to make CfD payments by LCCC dwindled as a result of the fall in electricity demand and low wholesale prices. To continue operating the scheme, the government decided to loan £75.1m to LCCC to cover the shortfall. This will be repaid in Q2’21. However, the LCCC interim levy is forecast at £9.733/MWh for Q4’2020, up 14% from Q3’2020.

The FiT is a charge on suppliers to support small scale renewable generators (<5MW capacity). The scheme closed to new projects in 2018, but existing participants are guaranteed subsidies for 20 years.

Subsidies paid to generators will continue to be made and it’s even anticipated to increase slightly to account for an overall decline in volume demand.

There is one more non-energy costs that is expected to increase: the Renewable Obligation (RO). RO requires suppliers to source a percentage of their electricity from renewable sources. Suppliers recoup this charge from consumers. The scheme has been replaced by CfD but still exists to support renewable projects agreed before 2017.

RO payments have been mutualised for the past three years as a number of suppliers have failed to meet their commitments and gone out of business. Given the current challenging economic climate and the impact of further lockdowns on businesses and energy demand, the industry anticipates future supplier exists and the ensuing RO mutualisation.

(1) Cornwall Insight business energy market report October 2020

(2) Grant Thornton survey of 642 senior decision makers in UK mid-market businesses December 2020. Turnover between £50m-£500m

(3) Non-energy costs including Policy and BSUoS cost index growth for a sample customer with a non-half hourly meter: Charges & Levies include RO, CCL, CfDs, CM. Transmission/Distribution components include TNUoS, BSUoS, DUoS

(4) UK power prices for Winter 20/Summer 21: ICE UK Power Settlement Prices

(5) National Grid ESO Monthly Insights, Elexon and Sheffield Solar