As part of Ofgem’s Targeted Charging Review (TCR), the way in which Network Operators recover their costs from suppliers is changing. It means from the 1 April 2022, the distribution of these network charges will partly shift away from Unit Rates and into Standing Charges. And as a result, energy suppliers may change the way they price their electricity contracts. But what exactly does this mean for your business?

Ralph Smith, Non-Commodity Cost Analyst at British Gas, outlines the new changes coming our way and how your business energy costs may be effected.

TCR in a nutshell

The Targeted Charging Review was initiated by Ofgem to look into how network charging (DUoS and TNUoS) could be made fairer across all consumer groups. The concern was that the costs of maintaining the grid have been steadily increasing over recent years, yet they were passed onto an increasingly smaller number of users.

The reason for this is the nature of energy generation and consumption has changed radically in recent times. Energy efficiency measures, embedded generation and load shifting have all meant that a growing number of consumers can minimise or even avoid any reliance on the grid, and therefore their exposure to the current charging regimes of DUoS (Red/Amber/Green Unit Rates) and TNUoS (Peak/Triad charging).

The objective of the TCR is to reinstate a fairness for everyone involved, while making sure network operators recover the revenue they need to maintain the transmission and distribution systems.

The new charging structure

Ofgem believes the most effective way to make sure everyone contributes fairly is through a fixed p/day charge. The level of charge you will pay is determined by the TCR Band your site is allocated – a task that’s carried out by the distribution networks.

They will base their allocation on the capacity of a site for the following:

- a Current Transformer meter (measurement classes C and E)

- and Estimated Annual Consumption for Non-Half Hourly meters and non-Current Transfer Half Hourly meters (measurement class G).

As a result of these changes, OFGEM predicts sites of similar size will pay broadly the same amount for using system.

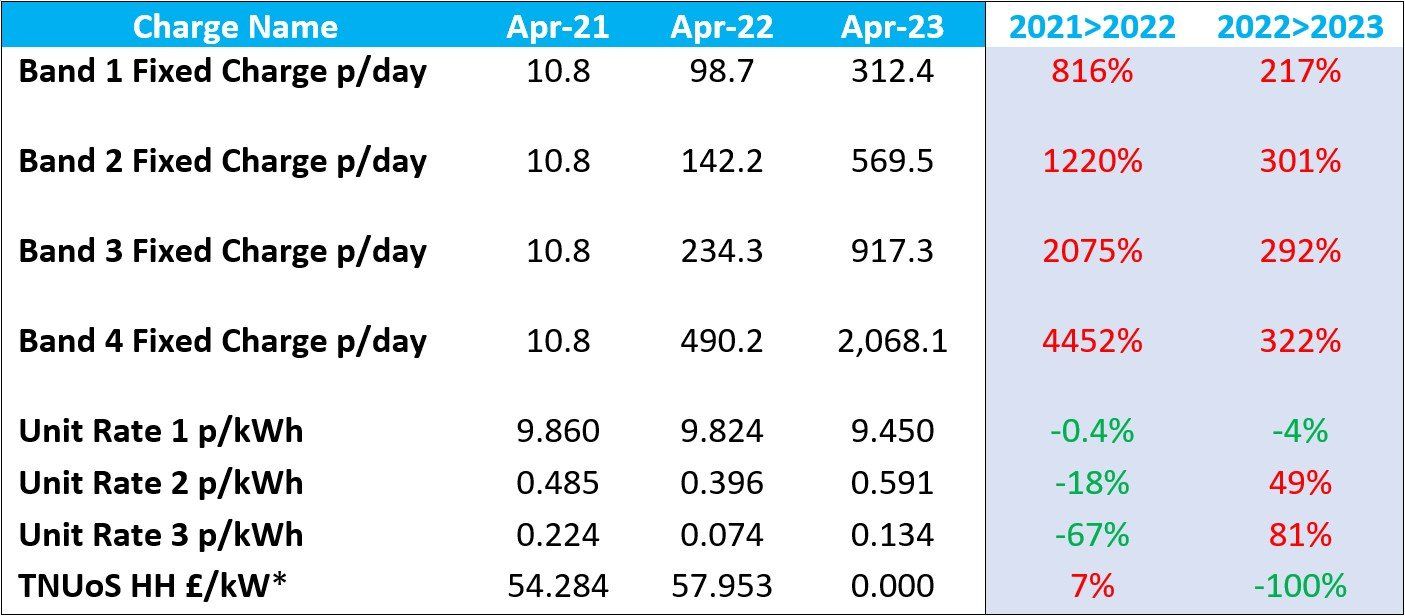

The below table (DNO 10 HH Low Voltage) demonstrates the scale of the shift towards fixed charges, as well as the range of charge between the four TCR bands. However, movements will vary significantly between regions and voltage types.

What to expect

The new fixed day charges will affect all business electricity customers with a NHH or HH meter mentioned above and the impact on your bill could be significant. However, their roll out is staggered. From 1 April 2022, the distribution (DUoS) element of the change will take place. The transmission (TNUoS) element will take place a year later, in April 2023.

The below demonstrates how two sites with similar consumption could fair differently as a result of the TCR changes.

Next steps

If your business is currently on a flexible energy contract, you’ll see these changes from your April invoices onwards. However, if your business is on a fixed contract, nothing will change straightaway. Instead, you’ll likely see these changes reflected in your renewal price.

If you have any questions about the TCR or need advice on making sure you have the right energy strategy or energy plan in place for your business, please contact your Customer Manager.