Exceptionally high wholesale energy prices add to the October rush

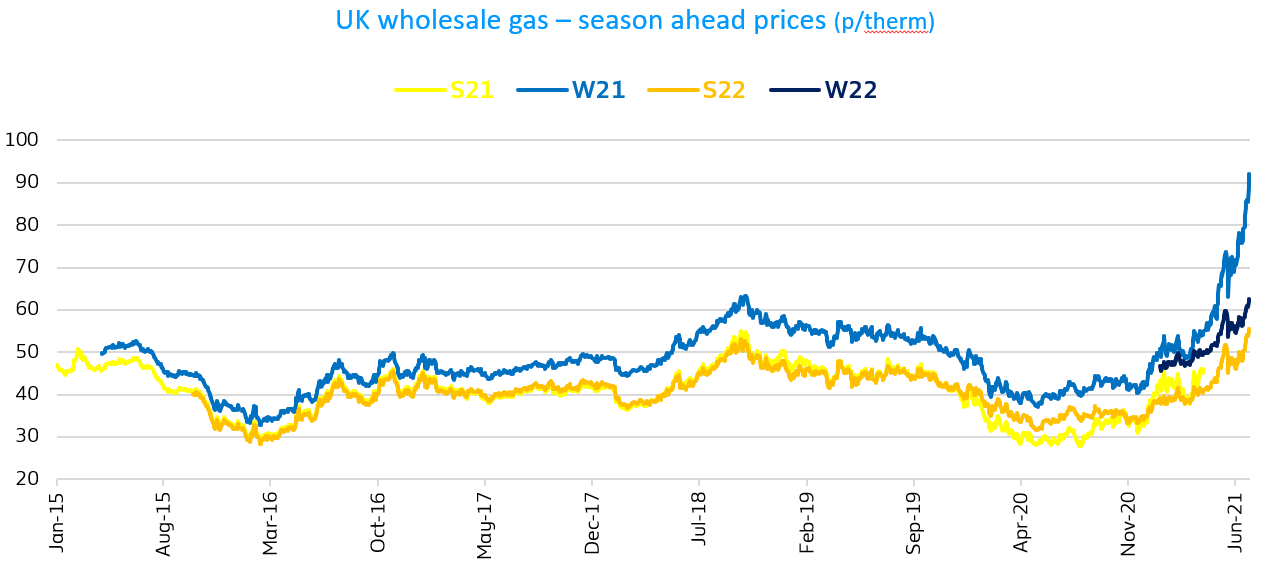

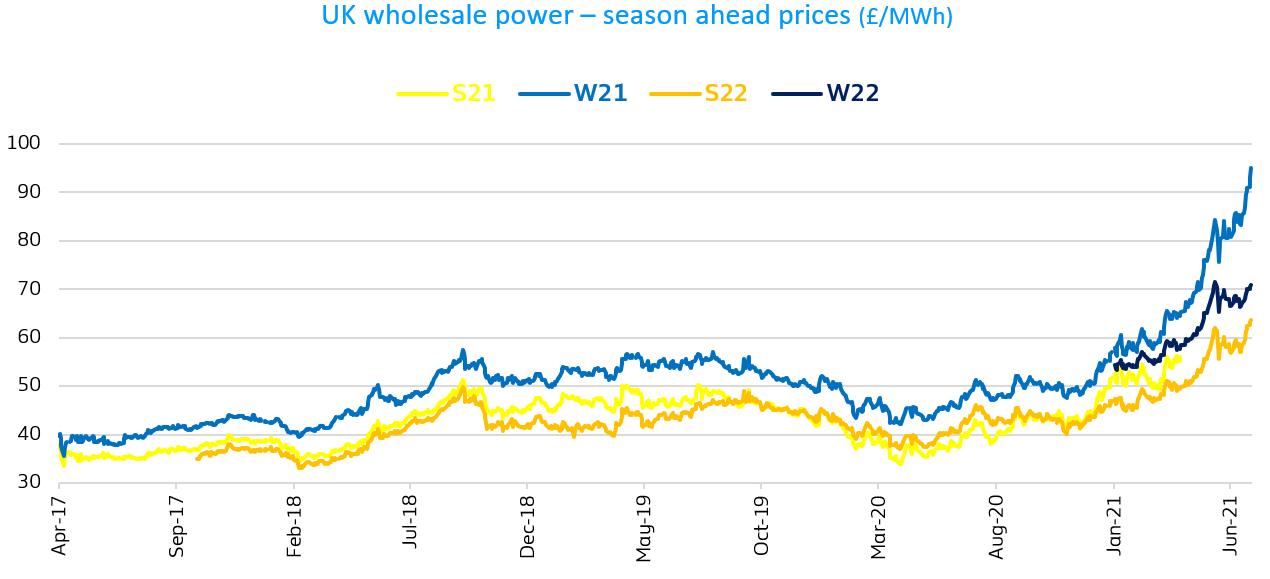

Front and season ahead power and gas prices have reached exceptional levels during Q2’21.

Winter 21 gas prices have increased by 81% in the first half of 2021 and are up by 124% compared to a year ago(8).

As approximately 40% of electricity generated in the UK comes from gas-fired power plants, what happens in the gas market directly influences power prices. Winter 21 power prices have increased by 64% in the first six months and are 95% higher than in the last 12 months.

The causes are well-rehearsed, including:

- European gas storage levels at historical lows for this time of year

- Planned Norwegian field maintenance with the risk of delays priced into the season ahead prices

- Unseasonably colder temperatures in June and going into JulyDemand for LNG remains strong in Asia as a result few tankers are scheduled to arrive in the UK

- Gas exports from Russia to Europe have declined to one-fifth this year compared to pre-Covid levels

- Carbon prices reaching new record highs

- Renewed optimism over a strong recovery from the impact of the pandemic and a return to normality due to the successful rollout of vaccine programmes. The Bank of England has projected that the economy will grow by 7.25% in 2021(9)Fiscal stimulus by major economies and EU and UK green recovery plans

- The rest of the energy complex has also seen prices reach new highs. Oil was trading at 74.76$/bbl by the end of June, up from a low of 19.33$/bbl in April 2020, whilst coal prices have climbed to their highest level in a decade driven by demand from China and supply disruptions in South America and Asia

Talks about an energy market supercycle sounded premature back in early March but as we enter into the second half of 2021 it seems inevitable.

In early July, Winter 21 gas and power prices broke (momentarily) through the 100 ceiling - 100p/therm and £100/MWh respectively.

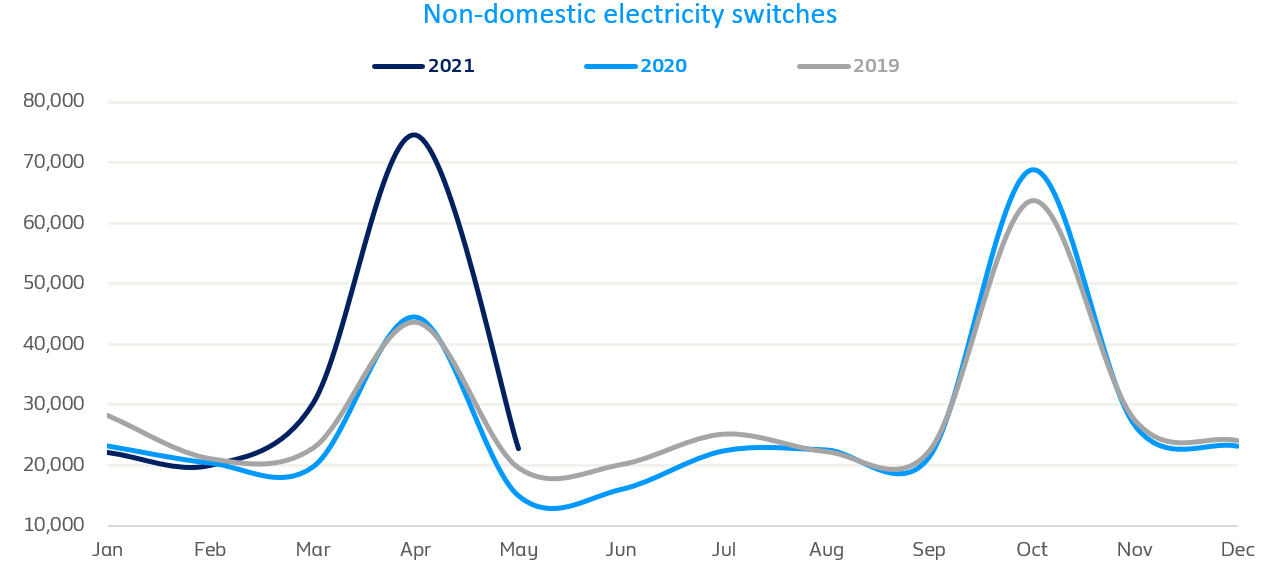

With business energy prices spiralling higher in the run-up to winter, this October’s peak business energy switching season could be busier than ever.

April and October are peak months for business energy switching. Already the number of switches in April was 68% higher than in the same month in 2020. In total, 74,568 businesses of all sizes switched suppliers compared to 44,488 in April last year(10).

Sources & Notes:

(8) UK gas and power wholesale prices for Summer 21, Winter 21, Summer 22 & Winter 22: ICE UK Settlement Prices

(9) The Bank of England forecasts 7.25% growth in 2021, 6th May 2021

(10) Energy UK electricity switching report May 2021